XM Review

XM Broker Review 2025: A Comprehensive Analysis of Features, Fees, and Trading Conditions

In the competitive world of online trading, choosing the right broker is crucial. XM, established in 2009, has emerged as a top choice for traders worldwide, offering competitive spreads, high leverage up to 1:888, and a user-friendly trading experience. Regulated by multiple authorities and serving over 5 million clients, XM combines security with flexibility. This review dives deep into XM’s regulatory framework, trading instruments, platforms, fees, and customer support to help you determine whether XM aligns with your trading goals.

About XM - A Trusted Broker for Global Traders

XM is a leading forex and CFD broker, serving over 5 million clients across 190 countries. Regulated by multiple financial authorities, including CySEC, FCA, ASIC, and IFSC, XM offers a secure trading environment. The broker provides a wide range of instruments, including forex pairs, commodities, indices, stocks, and cryptocurrencies, catering to both retail and professional traders. XM is known for its educational resources, competitive spreads, flexible account types, and user-friendly platforms, making it a popular choice among traders globally.

Is XM Safe? A Look at Regulation and Security Measures

Security and regulatory compliance are critical when choosing a broker. XM ensures a safe trading environment through the following measures:

Regulatory Compliance | Ensures safety of clients’ funds and a transparent trading environment. |

Guidelines Adhered To |

|

Protection Features | Negative balance protection to prevent losses exceeding account balance. |

Security Measures |

|

What Can You Trade on XM? A Wide Range of Instruments

Trading Instruments | Details |

Forex | Over 55 currency pairs |

Commodities | Gold, silver, oil, and natural gas |

Indices | S&P 500, NASDAQ, and FTSE 100 |

Stocks | CFDs on shares of leading companies |

Cryptocurrencies | Bitcoin, Ethereum, and Litecoin |

While the range of cryptocurrencies and stocks is somewhat limited, the overall portfolio allows for diversified trading.

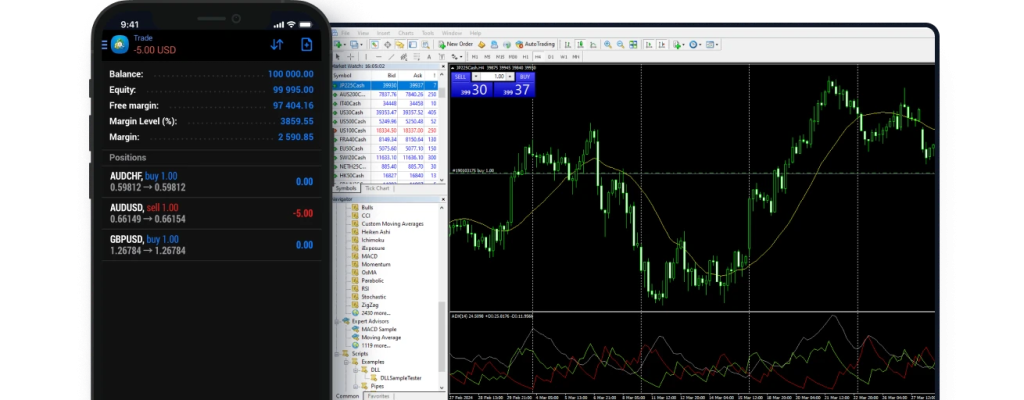

Trading Platforms: MT4, MT5, and XM’s Proprietary Tools

Trading Platforms | Details |

MetaTrader 4 (MT4) | Available on desktop, web, and mobile devices. Offers advanced charting tools, technical indicators, and automated trading capabilities. |

MetaTrader 5 (MT5) | Available on desktop, web, and mobile devices. Offers advanced charting tools, technical indicators, and automated trading capabilities. |

XM Web Terminal | XM’s proprietary web-based platform for seamless trading. |

XM Mobile App | XM’s proprietary mobile app for trading on the go. |

Choosing the Right XM Account: Ultra Low vs. Zero Account

t: Ultra Low vs. Zero Account

| Account Types | Minimum Deposit | Spreads and Commissions | Leverage | Stop Out Level |

| Ultra Low Account | $5 | Low spreads and even lower swap fees and commissions | 30:1 | 50% |

| Zero Account | $5 | Fixed commissions and spreads as low as zero | 30:1 | 50% |

XM’s Spreads, Fees, and Leverage: A Competitive Edge

Feature | Description |

Spreads | Competitive pricing with tight spreads, starting from as low as 0 pips. |

Fees |

|

Leverage | Up to 1:888, significantly higher than most competitors. |

The broker does not charge deposit or withdrawal fees, though third-party providers may impose their own fees.

Fast and Flexible: Deposits and Withdrawals on XM

XM supports various payment methods:

Category | Description |

Payment Methods |

|

Deposit Time | Instant |

Withdrawal Time | Typically processed within 24 hours |

24/7 Customer Support

Pros

XM offers 24/7 customer support through live chat, email, and phone. The support team is knowledgeable and responsive, though occasional delays during peak times have been reported.

Learning to Trade: XM’s Educational Offerings

XM provides tutorials, guides, webinars, seminars, market analysis, and an economic calendar. While useful, the educational offerings could be more comprehensive.

Is XM Right for You? A Balanced Look at Its Pros and Cons

Pros

- Strong regulatory framework.

- Competitive spreads and low fees.

- High leverage options.

- Wide range of trading instruments.

- User-friendly platforms.

- Multiple account types.

- Efficient deposit and withdrawal processes.

- Responsive customer support.

Cons

- Limited range of cryptocurrencies and stocks.

- Educational resources could be more comprehensive.

- Occasional delays in customer support.

Conclusion

XM is a reliable and trustworthy broker offering a robust trading environment for both beginners and experienced traders. Its competitive pricing, diverse range of instruments, and user-friendly platforms make it an attractive choice. While there are areas for improvement, XM’s strengths far outweigh its weaknesses, making it a solid option for traders seeking a transparent and efficient broker. Always conduct your own research and consider your trading goals before choosing a broker.