Blueberry Markets Review

OANDA Review 2025: A Trusted Broker for Forex and CFD Traders

Founded in 1996 and regulated by top-tier authorities, OANDA has established itself as a trusted name in the forex and CFD trading industry. Known for its competitive spreads, advanced trading platforms, and robust customer support, OANDA caters to traders of all experience levels. In this review, we explore its features, fees, and overall trading experience to help you decide if it’s the right broker for your needs.

OANDA’s Security and Regulation: A Trusted Trading Environment

OANDA operates under stringent regulatory oversight, holding licenses from several esteemed financial authorities:

Financial Conduct Authority (FCA) in the United Kingdom

Commodity Futures Trading Commission (CFTC) in the United States

Australian Securities and Investments Commission (ASIC) in Australia

Investment Industry Regulatory Organization of Canada (IIROC) in Canada

This extensive regulatory framework ensures that OANDA adheres to high standards of financial practice, providing traders with a secure and transparent trading environment. The broker employs advanced encryption technologies to protect clients’ personal and financial information and enforces strict Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures to enhance account security.

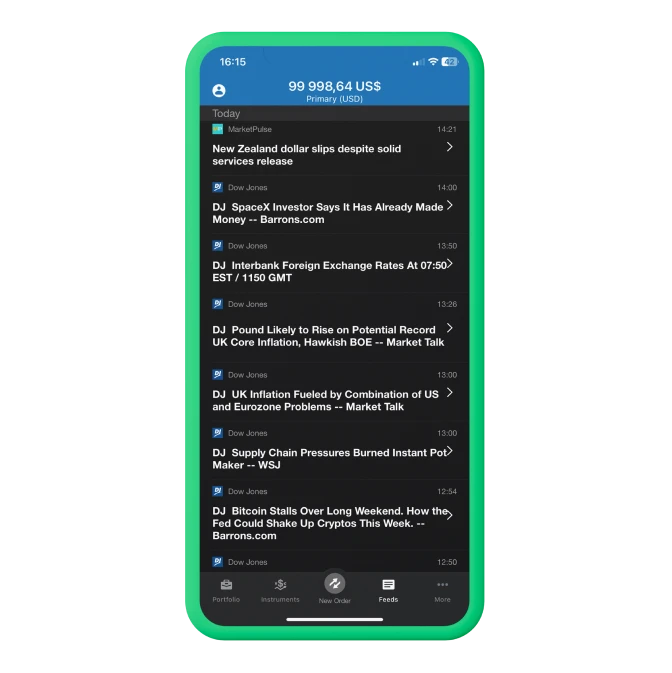

OANDA Trading Platforms: MT4, MT5, and More Compared

OANDA offers a selection of trading platforms designed to accommodate various trading styles and preferences:

Platform | Features |

OANDA Trade Platform |

|

MetaTrader 4 (MT4) |

|

MetaTrader 5 (MT5) |

|

TradingView Integration |

|

Standard vs. Elite: A Comparison of OANDA’s Account Options

Below is a comparison of OANDA’s Standard and Elite accounts to help you choose the right one for your trading style.

Feature | Standard Account | Elite Trader Loyalty Program |

Minimum Deposit | None | Contact OANDA for details |

Spreads | Floating, starting from 0.6 pips | Lower spreads |

Commission | No commission | No commission |

Leverage | Up to 50:1 (varies by region) | Up to 50:1 |

Dedicated Support | Standard customer service | Priority customer service |

OANDA Trading Costs: A Breakdown of Fees and Spreads

OANDA’s fee structure is competitive and transparent:

Fee Type | Details |

Spreads | Variable spreads starting from 0.6 pips for EUR/USD |

Commission | No commission on trades |

Deposit Fees | No fees on most deposit methods |

Withdrawal Fees | Varies by payment method |

Inactivity Fees | $10 per month after 12 months of inactivity |

Overnight Fees | Charged based on market interest rates |

OANDA Deposits & Withdrawals: Payment Methods Explained

OANDA supports multiple payment methods for seamless transactions:

Payment Method | Processing Time | Fees |

Bank Transfer | 1-5 business days | Varies |

Credit/Debit Cards | Instant | No fees |

PayPal | Instant | No fees |

Skrill & Neteller | Instant | May incur fees |

Withdrawal processing times depend on the selected payment method, and some transactions may incur fees.

OANDA Customer Support: Reliable Assistance for Traders

- 24/5 Live Chat: Immediate assistance.

- Email/Phone Support: Responsive during business hours.

- FAQ Section: Comprehensive resource for common queries.

Enhance Your Trading Knowledge with OANDA’s Expert Resources

- Trading guides, webinars, video tutorials, and daily market analysis to enhance trading skills.

OANDA Pros & Cons: Is It the Right Broker for You?

Pros

- Multi-jurisdictional regulation for trust and security.

- Competitive spreads and no minimum deposit.

- Advanced platforms (MT4, MT5, TradingView).

- Excellent customer support and educational resources.

Cons

- Limited leverage (up to 1:50).

- No copy trading or social trading features.

Conclusion

OANDA is a reliable and transparent broker, offering competitive spreads, advanced platforms, and robust regulatory compliance. While its leverage options are limited, its no-minimum-deposit requirement and comprehensive educational resources make it an excellent choice for beginners. For experienced traders, the Elite Trader Loyalty Program tight spreads and low commissions provide a cost-effective trading solution. Whether you’re a novice or a seasoned professional, OANDA’s combination of user-friendly platforms, competitive pricing, and strong customer support makes it a top contender in the forex and CFD trading industry.