NAGA Review

NAGA Review: A Social Trading Platform for Modern Traders

Founded in 2015, NAGA has emerged as a leading social trading platform, combining traditional trading with innovative social and copy trading features. With its user-friendly interface and diverse range of trading instruments, NAGA caters to traders of all experience levels. This review explores its regulatory framework, trading platforms, account types, fees, and more to help you decide if NAGA is the right broker for you.

NAGA’s Regulatory Framework: Ensuring a Safe Trading Environment

One of the most critical aspects of choosing a broker is ensuring it operates under proper regulatory oversight. NAGA is regulated by the Cyprus Securities and Exchange Commission (CySEC), providing traders with a level of trust and security.

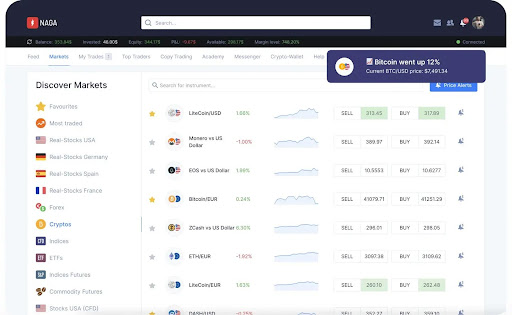

Powerful Trading Platforms for Every Trader

NAGA provides traders with multiple platforms, ensuring accessibility across different devices:

Platform | Features |

MetaTrader 4 (MT4) | Advanced charting tools, technical indicators, automated trading (EAs). |

MetaTrader 5 (MT5) | More timeframes, additional order types, expanded technical analysis tools. |

NAGA WebTrader | Intuitive web-based platform, ideal for beginners, integrates social trading. |

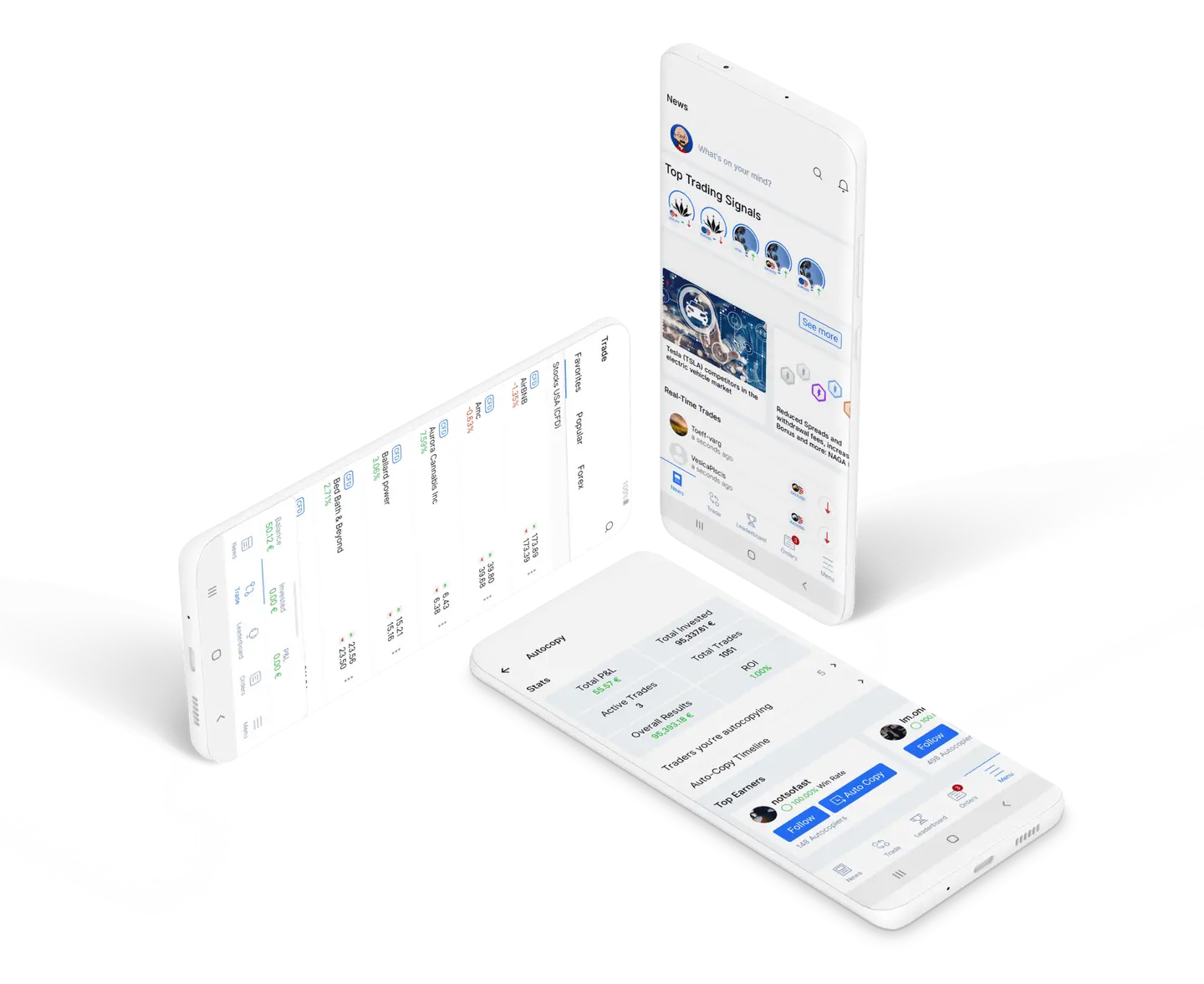

NAGA Mobile App | iOS and Android support, full trading functionality, social trading integration. |

Key Advantage: All platforms integrate social trading features, allowing users to follow, interact with, and copy professional traders easily.

NAGA’s Trading Instruments: A Diverse Market Selection

NAGA provides an extensive range of trading instruments, catering to various trading preferences:

Instrument | Details |

Forex | Over 50 currency pairs, including major, minor, and exotic pairs. |

Stocks | CFDs on popular stocks from major exchanges like NASDAQ, NYSE, and FTSE. |

Indices | Trade major indices such as the S&P 500, DAX 30, and NASDAQ 100. |

Commodities | Includes gold, silver, crude oil, and natural gas. |

Cryptocurrencies | Supports popular cryptos like Bitcoin, Ethereum, and Ripple. |

ETFs | Access to a variety of exchange-traded funds (ETFs). |

Futures | For advanced traders looking to speculate on commodity and index futures. |

Flexible Account Types to Suit Your Trading Style

NAGA offers several account types tailored to different levels of traders:

Account Type | Minimum Deposit | Features |

Iron | $250 | Basic account for beginners, suitable for those new to trading. |

Bronze | $2,500 | Improved trading conditions compared to the Iron account. |

Silver | $5,000 | Access to better spreads and enhanced trading features. |

Gold | $25,000 | Premium features, personalized support, and tighter spreads. |

Diamond | $50,000 | Best spreads, exclusive perks, and priority customer service. |

VIP Account | Custom | Tailored features, personal account managers, and institutional-level trading conditions. |

Demo Account | $0 | Risk-free practice account with virtual funds to test strategies and platforms. |

Competitive Pricing: Low Spreads and Transparent Fees

NAGA’s fee structure is competitive but varies based on account type:

- Forex spreads: Starting from 0.7 pips on major pairs.

- Stock CFD fees: Commission-based, starting from 0.2% per trade.

- Cryptocurrency trading fees: 1% commission on crypto CFD trades.

- Inactivity fee: Charged after 3 months of inactivity.

- Withdrawal fees: Fixed withdrawal fee of $5 per transaction.

While NAGA’s spreads are competitive, the commission on stock and crypto trading may be higher compared to other brokers.

High Leverage and Risk Management Tools

Leverage options at NAGA depend on the regulatory jurisdiction and trader classification:

- Retail clients: Maximum leverage up to 1:30 (as per ESMA regulations).

- Professional clients: Can access leverage up to 1:200.

- Cryptocurrency trading: Leverage capped at 1:5.

Negative balance protection ensures that traders do not incur losses beyond their deposited funds.

NAGA Deposit & Withdrawal: Fast, Secure, and Flexible Payment Options

NAGA supports multiple payment methods for deposits and withdrawals:

- Multiple Payment Methods: Bank transfers, credit/debit cards, e-wallets (Skrill, Neteller, PayPal), and cryptocurrencies.

- Instant Deposits: Start trading immediately.

- Fast Withdrawals: Processed within 24-48 hours.

- Withdrawal Fee: $5 per transaction.

Earn While You Trade: NAGA’s Social Trading Revolution

NAGA differentiates itself with its social trading ecosystem, where traders can:

- Copy Trading: Automatically copy the trades of top-performing traders.

- Community Interaction: Engage with other traders through the NAGA community.

- Earn Commissions: Get rewarded when others copy your trades.

These features make it an excellent choice for beginners who prefer to follow experienced traders instead of making independent trading decisions.

Empower Your Trading with NAGA Education

NAGA provides several educational tools, including:

- Webinars and seminars hosted by experts.

- Video tutorials covering platform usage and trading strategies.

- Blog posts and market analysis for continuous learning.

However, there is a lack of structured learning courses or interactive quizzes, which could enhance the educational experience.

NAGA Customer Support: Reliable Assistance for Traders

NAGA offers:

- 24/5 Support: Available via phone, email, and live chat.

- Extensive Resources: FAQ section and educational materials.

- Responsive Team: Quick assistance for technical and account-related queries.

While the support team is knowledgeable, some traders have reported delays in resolving complex account-related issues.

Is NAGA Best for You? Pros and Cons

Pros

- Wide range of trading instruments.

- Competitive spreads and low commissions.

- High leverage for professionals.

- Negative balance protection.

- Excellent customer support and social trading features.

Cons

- Limited regulatory oversight (no ASIC regulation).

- Inactivity fees after 12 months.

- Limited educational resources compared to competitors.

Conclusion

NAGA is a versatile and reliable broker, offering a wide range of trading instruments, competitive pricing, and innovative social trading features. Its user-friendly platforms and strong regulatory oversight make it suitable for traders of all experience levels. While the lack of ASIC regulation and inactivity fees are drawbacks, NAGA’s strengths—such as its social trading tools and competitive pricing—make it a strong contender in the online trading space. Whether you’re a beginner or an experienced trader, NAGA is worth considering for your trading journey.