Admirals Review

Review of Admirals: A Trusted Broker for Traders

Admiral Markets, now rebranded as Admirals, is a well-established online broker with over two decades of experience in the financial markets. Founded in 2001, Admirals has earned a strong reputation for its diverse trading instruments, competitive conditions, and reliable platforms. This review explores the broker’s regulatory framework, trading offerings, platforms, fees, customer support, and educational resources to provide a holistic understanding of what the broker brings to the table.

Ensuring Safety and Compliance: Admirals' Strong Regulatory Framework

Admirals operate under the regulation of top-tier financial authorities, ensuring that your funds and trades are protected. These include:

- Financial Conduct Authority (FCA) in the UK

- Cyprus Securities and Exchange Commission (CySEC)

- Australian Securities and Investments Commission (ASIC)

These regulators enforce strict standards, such as segregated client accounts, regular audits, and financial transparency, ensuring a secure trading environment. The broker also provides negative balance protection, safeguarding traders from losing more than their account balance—a crucial feature for those using leverage. Additionally, Admirals is a member of the Investor Compensation Fund (ICF) in Cyprus, offering further protection in the unlikely event of the broker’s insolvency.

iFOREX Regulation & Security: Ensuring Safe and Compliant Trading

One of the primary concerns for online traders is the safety of their funds and personal information. iFOREX addresses this concern by adhering to stringent regulatory standards. The platform is regulated by the Cyprus Securities and Exchange Commission (CySEC) and other reputable financial authorities, ensuring that it operates in compliance with international laws and best practices. Additionally, iFOREX employs advanced encryption technologies to safeguard user data and transactions, providing traders with peace of mind.

Admirals' Extensive Trading Instruments for Every Trader

Admirals offers access to over 4,000 trading instruments, catering to a wide range of traders. Whether you’re a beginner or an experienced trader, you can find opportunities to diversify your portfolio. Some of the asset classes available include: These include:

Asset Class | Details |

Forex | Major, minor, and exotic currency pairs with competitive spreads and leverage up to 1:500 (depending on jurisdiction). |

CFDs on Stocks | Trade shares of global companies like Apple, Amazon, and Tesla without owning the underlying asset. |

Indices | Access major indices such as the S&P 500, NASDAQ, FTSE 100, and DAX 30. |

Commodities | Trade CFDs on gold, silver, oil, and natural gas. |

Cryptocurrencies | Speculate on Bitcoin, Ethereum, Ripple, and Litecoin with CFDs. |

ETFs | Invest in exchange-traded funds for diversified exposure. |

This extensive range of instruments makes Admirals suitable for traders of all experience levels and trading strategies.

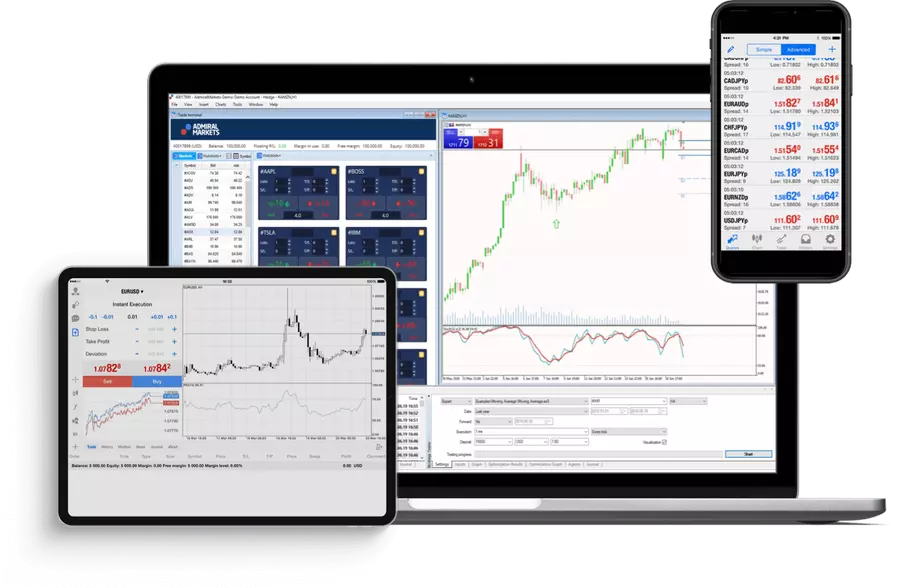

Popular Trading Platforms for Every Trader

Admirals supports some of the most popular trading platforms in the industry:

Platform | Description | Availability | Key Features |

MetaTrader 4 (MT4) | A widely-used platform known for its user-friendly interface and advanced trading tools. | Desktop, Mobile |

|

MetaTrader 5 (MT5) | The successor to MT4, offering additional features and improved functionality. | Desktop, Mobile |

|

WebTrader | A browser-based platform compatible with MT4 and MT5, eliminating the need for software downloads. | Web Browser |

|

Mobile App | A mobile trading app for iOS and Android, providing full functionality for trading on the go. | iOS, Android |

|

The availability of multiple platforms ensures traders can choose the one that best suits their style. Admirals also provide tools like technical indicators, charting tools, and expert advisors (EAs) to enhance the trading experience.

Powerful Platforms for Every Trader: Discover Admirals' Account Types

Admirals offers several account types to cater to different trading needs:

Account Type | Minimum Deposit | Trading Instruments | Leverage (Forex) | Commission |

Trade.MT5 | €250 | Forex, Metals, Energies, Stocks, ETFs, Bonds | Up to 1:500 (Professional Clients) | Commission-free on most instruments; specific conditions apply for certain assets |

Trade.MT4 | €250 | Forex, Metals, Energies, Stocks | Up to 1:500 (Professional Clients) | Commission-free on most instruments; specific conditions apply for certain assets |

Zero.MT5 | €250 | Forex, Metals, Energies | Up to 1:500 (Professional Clients) | Spreads from 0 pips with a commission of 1.8–3.0 per lot |

Zero.MT4 | €250 | Forex, Metals, Energies | Up to 1:500 (Professional Clients) | Spreads from 0 pips with a commission of 1.8–3.0 per lot |

Invest.MT5 | €1 | Real Stocks and ETFs | No leverage | Commission applies per transaction |

Understanding Fees and Spreads: What Admirals Offers Traders

Admirals offers competitive pricing, with spreads starting from 0.5 pips on major forex pairs for standard accounts and 0 pips for Zero accounts (with a commission). Other fees include:

Fee Type | Details | Cost/Charges |

Spreads | – Standard Accounts (Trade.MT4/Trade.MT5): Starting from 0.5 pips on major forex pairs. – Zero Accounts (Zero.MT4/Zero.MT5): Starting from 0 pips with a commission of 1.8 −1.8−3.0 per lot. |

|

Overnight Financing (Swap Rates) | Charged for holding positions overnight. |

|

Inactivity Fee | Applied after 24 months of account inactivity. |

|

Withdrawal Fees | Varies depending on the payment method used. |

|

Deposit Fees | No fees for deposits. |

|

Get Help Anytime: Admirals’ Customer Support Team

Customer Support Feature | Details |

Availability | 24/5 support |

Support Channels | Live chat, email, phone |

Responsiveness | Knowledgeable and timely assistance |

FAQ Section | Covers account opening, deposits, withdrawals, and platform usage |

Empower Your Trading with Admirals' Comprehensive Educational Tools

Admirals is committed to empowering traders with educational resources, including:

- Webinars: Live sessions on technical analysis, risk management, and trading strategies.

- Video Tutorials: Short, easy-to-follow videos on platform navigation and trading tools.

- Articles and Guides: In-depth content on trading and investing topics.

- Demo Account: A risk-free environment for practicing strategies.

These resources cater to traders of all experience levels, from beginners to advanced.

Quick and Cost-Effective Deposits and Withdrawals at Admirals

Admirals supports multiple payment methods, including:

Payment Method | Processing Time | Fees |

Bank Transfer | Several business days | No deposit fees, withdrawal fees may apply |

Credit/Debit Cards | 1-2 business days | No deposit fees, withdrawal fees may apply |

E-Wallets (Skrill, Neteller, PayPal) | Within 24 hours | No deposit fees, withdrawal fees may apply |

Cryptocurrencies (Bitcoin, Ethereum) | Processed quickly | No deposit fees, withdrawal fees may apply |

Withdrawal Processing Time | Within 24 hours | Varies based on the payment method |

Weigh the Pros and Cons of Trading with Admirals

Pros

- Regulated by top-tier authorities (FCA, CySEC, ASIC).

- Wide range of trading instruments (4,000+).

- Multiple platforms (MT4, MT5, WebTrader, Mobile App).

- Competitive spreads and fees.

- Comprehensive educational resources.

- Excellent 24/5 customer support.

Cons

- Inactivity fee of €10/month after 24 months.

- Limited product portfolio (no options or futures).

Conclusion

Admirals is a reliable choice for traders seeking a secure and diverse trading environment. With its competitive fees, robust platforms, and excellent educational resources, it’s well-suited for both beginners and experienced traders. However, if you’re looking for advanced products like options or futures, you may need to explore other brokers. Ready to start your trading journey? Admirals offers a risk-free demo account to help you get started.