Z-Score Definition

A Z-score is a statistical measurement that quantifies how far a specific data point is from the mean of a dataset, expressed in terms of standard deviations. In finance and investing, Z-scores are widely used to assess variability, identify outliers, and evaluate the financial health of companies. The concept is also applied in risk management and trading strategies.

Key Takeaways

- A Z-score measures how far a value deviates from the mean in terms of standard deviations

- It has broad applications in statistics, trading, and corporate analysis.

- The Altman Z-score is widely used to predict bankruptcy risk based on key financial ratios.

- In finance, Z-scores help traders evaluate volatility and identify outliers in market behavior.

How Z-Score Works

- 1. Statistical Context:

- A Z-score measures the distance between a data point and the mean of a dataset, normalized by the standard deviation.

- A Z-score of 0 indicates that the value is equal to the mean.

- Positive Z-scores signify values above the mean, while negative Z-scores indicate values below it.

- 2. Financial Context:

- In trading, Z-scores help identify whether an asset's price or return deviates significantly from its historical average.

- In corporate analysis, the Altman Z-score predicts the likelihood of a company going bankrupt by analyzing key financial ratios.

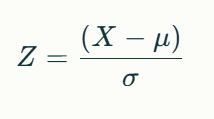

Formula for Z-Score

The general formula for calculating a Z-score is:

Where:

- X = Data point

- μ = Mean of the dataset

- σ = Standard deviation of the dataset

For corporate financial analysis, the Altman Z-score formula is:

Z=1.2(A)+1.4(B)+3.3(C)+0.6(D)+1.0(E)

Where:

- A=Working Capital / Total Assets

- B=Retained Earnings / Total Assets

- C=EBIT / Total Assets

- D=Market Value of Equity / Total Liabilities

E=Sales / Total Assets

Applications of Z-Score

- 1. Statistical Analysis:

- Identifies outliers in data distributions.

- Determines how unusual or typical a value is within a dataset.

- 2. Finance and Investing:

- Evaluates stock price volatility relative to historical averages.

- Assesses trading strategies by identifying deviations from expected performance.

- 3. Altman Z-Score (Corporate Health):

- Predicts bankruptcy risk:

- Above 3: Low risk; company is financially stable.

- 1.8–3: Moderate risk; caution advised.

- Below 1.8: High risk; potential bankruptcy within two years.

Advantages of Using Z-Scores

- Provides standardized comparisons across datasets or companies.

- Helps identify risks and opportunities in trading or corporate performance.

- Offers early warning signals for financial distress in companies.

Limitations

- Assumes normal distribution, which may not always apply in real-world data.

- The Altman Z-score may need adjustments for non-manufacturing sectors or private firms.

- It does not guarantee outcomes but serves as an indicator.

- By understanding and applying Z-scores effectively, traders and analysts can gain deeper insights into market trends, company health, and statistical anomalies for better decision-making.