Plus500 Review 2025

Explore the features and offering of Plus500, an established and publicly traded broker with

competitive spreads and multi-jurisdictional regulation.

Introduction

Choosing the right broker is essential for every trader — whether you’re just getting started or managing a professional portfolio. Plus500, a regulated brokerage founded in 2008, offers CFD trading via a streamlined proprietary platform and operates under multiple global licenses, including the FCA. In this review, we explore Plus500’s key features, costs, and offerings to help you determine if it fits your trading needs.

Overall Rationg

4.5

Why Choose Plus500?

Plus500 combines tight spreads, robust regulatory compliance, and a simplified user interface, making it ideal for traders who value ease of use and broad market access.

Broker Overview

Min. Deposit

Varies by instrument

Available Assets

2,800+

Account Type

Retail, Professional (upon qualification)

Education Materials

Trading Academy, videos, FAQs, eBook

Deposits & Withdrawals

Debit/Credit Cards, Bank Transfer, PayPal, Skrill

Customer Service

24/7 via Live Chat, WhatsApp, and Email

Asset Classes

Forex, Indices, Commodities, Stocks, ETFs, Options, Crypto

Regulation

FCA (UK), CySEC, ASIC, FSCA, FSA Seychelles, MAS Singapore

Security

SSL encryption, Segregated Funds, 2FA

Regulation & Security

Learn about Plus500‘s regulatory complience and security measures.

Security

SSL Encryption, Segregated Client Funds, Two-Factor Authentication (2FA), Session timeout for inactive users

High level of security for your trading

Regulations

FCA (UK) – License #509909, CySEC (Cyprus) – License #250/14, ASIC (Australia) – License #417727, FSCA (South Africa) – License #47546, FMA (New Zealand) – FSP No. 486026, FSA (Seychelles) – License #SD039, MAS (Singapore) – CMS License #CMS100648-1

Regulated broker ensuring compliance with international standards

Pros & Cons

Learn about Plus500e‘s regulatory complience and security measures.

Pros

- Access to 2,800+ CFDs across asset classes

- Easy-to-use proprietary platform (WebTrader)

- Strong regulation by top-tier authorities

- Guaranteed stop-loss orders available

- U.S. futures trading available

Cons

- No support for MetaTrader (MT4/MT5)

- Limited research tools beyond +Insights

- No phone support available

Broker Features at a Glance

Key features of top review brokers.

Trading Platform

Proprietary WebTrader platform. No MT4/MT5 support.

Asset Selection

2,800+ CFDs including Forex, Indices, Shares, Crypto, ETFs, and Options

Pricing & Leverage

Spreads only. Leverage up to 1:300 for qualified professionals. No commissions.

Risk Protection

Negative balance protection. Guaranteed stop-loss (with wider spreads)

Education

Trading Academy: Videos, eBook, beginner guides, KIDs

Support

24/7 via WhatsApp, Live Chat, and Email. No telephone support.

Trading with Plus500: Platform Comparison

Proprietary Platform

WebTrader offers real-time analysis tools, watchlists, and quick trade execution across web, desktop, and mobile. Charting features include technical indicators, sentiment analysis, and multi-chart layouts (up to 25 charts on 10 views). Ideal for users who prefer simplicity.

MetaTrader 4 / 5

Not supported. Plus500 is a closed system and does not support MT4/MT5 or third-party tool integration.

Account Types at Plus500

XM Group offers a versatile range of account types designed to meet the needs of all trader levels — from complete beginners to advanced scalpers and investors. Each account offers a distinct combination of spreads, leverage, and trading conditions, with full access to MetaTrader 4, MetaTrader 5, and XM WebTrader.

All real accounts support negative balance protection, and most offer a swap-free (Islamic) option.

Account Overview

- Micro Account: Ideal for beginners or low-risk traders. Trade micro-lots (1,000 units) with just $5.

- Standard Account: Designed for traditional traders using standard lot sizes, also starting at $5.

- Ultra Low Account: Best for cost-conscious or high-frequency traders, with spreads from 0.6 pips.

- Zero Account: Tailored for scalpers with spreads from 0 pips and fixed commissions.

- Shares Account: Enables direct investment in real stocks without leverage, starting from $10,000.

- Islamic Account: Swap-free option available across all main accounts to comply with Sharia law.

- Demo Account: Practice trading with virtual funds in a risk-free simulated environment.

XM Account Types Comparison Table (2025)

| Type | Min. Deposit | Spreads | Leverage | Key Features |

| Retail | Varies | Dynamic spreads | Up to 1:30 | Access to all CFDs, risk tools, negative balance protection |

| Professional | Qualification Required | Same as retail | Up to 1:300 | Higher leverage, same fee structure |

Trading Instruments

Plus500 offers an extensive range of over 2,800 tradable CFDs across multiple asset classes, giving traders the flexibility to diversify their strategies

Forex

Trade over 60 currency pairs, including major pairs (e.g., EUR/USD, GBP/USD), minor pairs (e.g., EUR/AUD, GBP/JPY), and exotic pairs (e.g., USD/TRY, EUR/ZAR). Real-time spreads and leverage options vary based on account type and region.

Stocks

Access global equity markets with CFD trading on individual shares from leading exchanges such as NYSE, NASDAQ, LSE, DAX, ASX, and more. Includes top-performing companies across tech, finance, healthcare, and energy sectors.

Indices

Trade CFDs on major country and sector indices, such as the S&P 500, FTSE 100, DAX 40, NASDAQ 100, and Japan’s Nikkei 225. Indices offer a way to speculate on broader market movements without selecting individual stocks.

ETFs

Diversify with CFDs on Exchange-Traded Funds (ETFs) that track indices, commodities, or sectors. Popular instruments include SPDR S&P 500 ETF (SPY) and iShares MSCI Emerging Markets ETF (EEM).

Commodities

Trade CFDs on hard and soft commodities including Crude Oil, Brent Oil, Natural Gas, and precious metals like Gold and Silver. Agricultural options such as Soybeans, Wheat, and Corn are also available.

Cryptocurrencies

Access CFDs on top digital currencies including Bitcoin, Ethereum, Litecoin, Ripple (XRP), and more. Availability depends on regional regulations. Crypto CFDs are available 24/7, excluding maintenance windows.

Options

Trade cash-settled CFDs on call and put options across multiple markets. Options are available on key indices, forex pairs, and commodities — allowing for strategic plays based on volatility or directional bias.

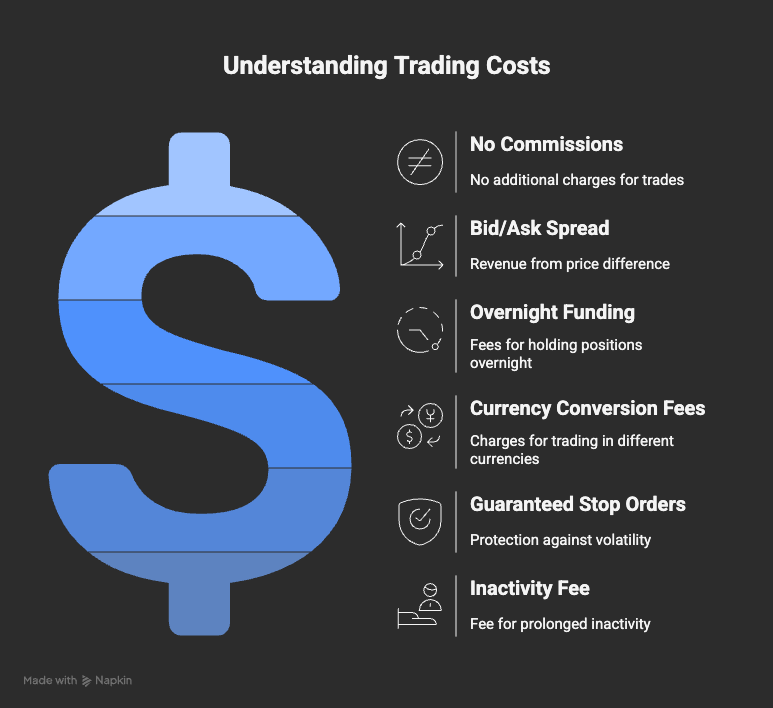

Spreads & Commissions

Plus500 operates on a spread-only pricing model, meaning traders don’t pay traditional commissions on trades.

No Commissions

All trading costs are embedded in the spread. There are no additional commission charges for opening or closing trades.

Bid/Ask Spread

Revenue is derived from the difference between the buy (ask) and sell (bid) price. Spreads are dynamic and vary by instrument, market conditions, and time of day.

Overnight Funding (Swap Rates)

Positions held open past a certain time (usually 10 PM GMT) incur an overnight fee, which may be positive or negative depending on the instrument and trade direction.

Currency Conversion Fees

A currency conversion fee of up to 0.7% applies when trading instruments denominated in a currency other than your account base currency.

Guaranteed Stop Orders

When enabled, Guaranteed Stop Orders ensure that trades close at a fixed price, even during high volatility. This adds protection but widens the spread for that trade.

Inactivity Fee

A $10/month inactivity fee applies after three consecutive months of no account login activity. The fee is deducted monthly until the balance reaches zero or the account becomes active again.

Leverage Options

Leverage levels vary depending on your classification as a Retail or Professional client and are also subject to local regulatory rules.

Retail Clients

Leverage is capped at 1:30 for major forex pairs, and lower for other instruments (e.g., 1:20 for non-major currency pairs, gold, and indices; 1:10 for commodities and non-gold metals; 1:2 for cryptocurrencies).

Professional Clients

Qualified clients can access leverage up to 1:300, depending on the instrument and location. To qualify, you must meet specific criteria related to trading volume, financial portfolio, and professional experience.

Risk Warning

Higher leverage increases both potential gains and potential losses. Plus500 offers negative balance protection for retail clients to prevent account overdrafts, but prudent risk management is essential.

Payment Methods

Plus500 supports a range of convenient and secure payment options for both deposits and withdrawals.

Deposit Methods

- Debit/Credit Cards – Visa, Mastercard

- Bank Wire Transfers – Local and international

- E-Wallets – PayPal and Skrill

- Digital Wallets – Google Pay and Apple Pay (availability may vary by region)

Withdrawal Policies:

- Withdrawals are typically processed within 1–3 business days.

- Most methods are fee-free, although third-party charges (e.g., from banks or payment processors) may apply.

- Minimum withdrawal amounts vary by method and are clearly displayed in the platform.

- Identity verification is required before funds can be withdrawn to comply with regulatory standards.

Customer Support

Plus500 offers multilingual 24/7 customer support, accessible directly from the trading platform or website.

Live Chat

Fastest response, available around the clock

Email Support

Support available via contact forms and direct email channels

Convenient for mobile-based customer queries

Note

- Plus500 does not offer phone-based support, focusing instead on efficient digital communication.

- The platform includes an extensive FAQ and Help Center, which covers topics such as deposits, withdrawals, trading tools, platform navigation, and account security.

Final Verdict

Plus500 stands out as a reliable, low-cost CFD broker with broad international appeal. As a publicly traded company listed on the London Stock Exchange (LSE: PLUS), and regulated by top-tier authorities including the FCA (UK), ASIC (Australia), CySEC (Cyprus), and others, it provides a strong sense of security and transparency for traders.

The platform’s primary strengths lie in its user-friendly interface, commission-free pricing, and wide range of over 2,800 CFDs across forex, stocks, indices, ETFs, commodities, cryptocurrencies, and options. It is well-suited for intermediate traders, casual investors, and those who value simplicity over complexity.

That said, there are notable limitations. The absence of MetaTrader 4/5 (MT4/MT5), lack of advanced charting or automated trading capabilities, and no phone support could be drawbacks for seasoned or algorithmic traders. The proprietary platform, while intuitive, may not satisfy users who prefer custom indicators, strategy testing, or high-frequency trading tools.

In terms of fees, Plus500 is transparent and competitive, offering tight spreads and no commissions, though users should be aware of overnight funding charges, currency conversion fees, and an inactivity fee after 3 months.

Overall, Plus500 is a dependable broker for those seeking manual trading with low costs, reliable regulation, and a streamlined experience. It’s particularly ideal for mobile-first traders and those who want to execute trades quickly without being overwhelmed by complex tools.

Now You Know More! Ready to Get Started?

Open an account with a trusted broker and start your trading journey today.

Now You Know More! Ready to Get Started?

Open an account with a trusted broker and start your trading journey today.

Frequently Asked Questions

Yes. Plus500 is a publicly traded company on the London Stock Exchange and is regulated by several reputable financial authorities including the FCA (UK), ASIC (Australia), CySEC (Cyprus), FMA (New Zealand), and FSCA (South Africa). It is widely recognized as a secure and trustworthy platform.

No. Plus500 operates on a spread-only model, meaning there are no additional commissions for opening or closing trades. The platform earns revenue through the bid/ask spread.

No. Plus500 does not support MT4 or MT5. It provides a proprietary trading platform available on web, desktop, and mobile, designed to be easy to use but limited in advanced features.

Leverage amplifies both gains and losses. Retail clients can use leverage up to 1:30, while professional clients may access up to 1:300, depending on approval. Plus500 provides negative balance protection for retail accounts to limit losses, but risk management is essential.

Withdrawals are typically processed within 1–3 business days. The platform supports multiple payment methods, including credit/debit cards, bank transfers, PayPal, and Skrill. No withdrawal fees are charged by Plus500, though external processing fees may apply.

Yes. If you do not log into your account for three consecutive months, Plus500 charges an inactivity fee of $10 per month until the account becomes active again or the balance reaches zero.

Yes, you can trade CFDs on popular cryptocurrencies like Bitcoin, Ethereum, Litecoin, and more, depending on your region. Crypto CFDs are available 24/7, though leverage is limited (typically 1:2) and may be restricted in some jurisdictions due to local regulations.

Yes. Plus500 offers a free and unlimited demo account where users can practice trading with virtual funds. It’s a great way to test strategies or become familiar with the platform before investing real money.

Yes. The platform’s clean interface, simple order execution, and quick onboarding process make it an excellent choice for beginners. However, it lacks in-depth educational tools and trading signals that some other brokers offer.

No. Plus500 does not provide phone support. All customer service interactions are handled through live chat, email, and WhatsApp, with 24/7 availability.