FxPro Review 2025

Explore the features and offerings of FxPro, an established leader

in the trading broker space.

Introduction

Choosing the right broker is essential for every trader — whether you’re just getting started or managing a professional portfolio. FxPro, a regulated brokerage launched in 2006, has been drawing attention for its advanced trading platforms, wide asset selection, and competitive pricing. In this review, we dive deep into FxPro’s offerings to help you decide whether it fits your trading needs.

Overall Rationg

4.6

Why Choose FxPro?

FxPro combines a robust suite of professional-grade trading platforms with competitive pricing, making it appealing to both beginner and experienced traders. The broker offers tight spreads across major and minor currency pairs, helping traders optimize costs while executing strategies efficiently.

Broker Overview

Min. Deposit

$100

Available Assets

2,100+

Account Type

MT4 Instant Execution, MT4 Market Execution, MT5, cTrader

Education Materials

Market insights, webinars, trading guides

Deposits & Withdrawals

Instant deposits, standard withdrawal times (1–3 business days)

Customer Service

24/5 multilingual support via email and phone

Asset Classes

Forex, Stocks, Commodities, Indices, Cryptocurrencies

Regulation

Regulated by FCA (UK), FSCA (South Africa)

Security

SSL encryption, Two-Factor Authentication, Segregated client funds

Regulation & Security

Learn about FxPro‘s regulatory complience and security measures.

Security

SSL encryption, Two-Factor Authentication (2FA), Segregated client funds

Understanding a broker’s regulatory standing and security infrastructure is critical for trust.

Regulations

FCA (UK), (South Africa)

Regulated broker ensuring compliance with international standards

Pros & Cons

Learn about FxPro‘s regulatory complience and security measures.

Pros

- Advanced trading platforms (MT4, MT5, cTrader)

- Access to 2,100+ instruments

- Regulated by FCA and FSCA

- Tight spreads and competitive fees

- Multiple account types for all experience levels

- Extensive educational resources for traders.

Cons

- $100 minimum deposit may be high for some beginners

- Limited educational resources compared to some competitors

- No commission-free cTrader for all instruments

Broker Features at a Glance

Key features of top review brokers.

Trading Platform

MT4, MT5, and cTrader with real-time charts, indicators, and automation tools. Web, desktop, and mobile access available.

Asset Selection

Access over 2,100 instruments across Forex, Stocks, Commodities, Indices, and Cryptocurrencies.

Pricing & Leverage

Spreads from 0.6 pips. Leverage up to 1:500 depending on asset and regulation. Commission-free on MT4/MT5 accounts.

Risk Protection

Negative balance protection and segregated client funds.

Educational Resources

Market insights, trading guides, webinars.

Customer Support

24/5 support via email and phone. Multilingual options available.

Trading with FxPro: Platform Comparison

Proprietary Platform

FxPro’s proprietary web-based platform is designed for simplicity without sacrificing functionality. Traders benefit from real-time charts, customizable indicators, and fast trade execution, making it ideal for beginners or those who prefer an intuitive, streamlined interface. Its responsive design ensures seamless trading across devices, and integrated tools help users analyze markets, track performance, and execute strategies efficiently.

MetaTrader 4 / 5

For advanced traders, FxPro offers full access to MetaTrader 4 and MetaTrader 5, two of the most widely respected trading platforms in the industry. Both platforms provide a comprehensive suite of technical analysis tools, automated trading through Expert Advisors (EAs), and advanced order management. Available on desktop, web, and mobile, MT4/MT5 allows traders to monitor markets, implement sophisticated strategies, and maintain flexibility while trading on the go.

Account Types at FxPro

| Type | Min. Deposit | Spreads | Leverage | Key Features |

| MT4 Instant Execution | $100 | From 0.6 pips | Up to 1:500 | Quick execution, standard tools |

| MT4 Market Execution | $100 | From 0.6 pips | Up to 1:500 | Lower spreads, market execution |

| MT5 Account | $100 | From 0.6 pips | Up to 1:500 | Advanced trading, additional instruments |

| cTrader Account | $100 | From 0.4 pips + commission | Up to 1:500 | Professional tools, algorithmic trading |

Trading Instruments

FxPro gives traders access to a broad and diverse range of markets:

Forex

Major, minor, and exotic currency pairs

Stocks

Global equities via CFDs

Commodities

Precious metals, energy, and softs

Indices

Major and emerging market indices

Cryptocurrencies

Bitcoin, Ethereum, altcoins

Spreads & Commissions

FxPro is known for its competitive trading costs, designed to meet the needs of both beginners and professional traders. Spreads start from as low as 0.6 pips, though they vary depending on the account type, trading platform, and financial instrument. For most MT4 and MT5 accounts, trading is commission-free, allowing traders to focus on strategy rather than additional costs. This makes FxPro particularly attractive for forex traders and those trading CFDs on popular assets such as indices, metals, and commodities.

For traders using the cTrader platform, FxPro applies a small commission per trade. However, this is balanced by significantly tighter spreads, which can be beneficial for scalpers or high-frequency traders seeking cost-efficient execution. The combination of low spreads and flexible commission structures allows traders to choose an account type that aligns with their preferred trading style—whether it’s long-term positions, short-term scalping, or automated strategies.

In addition, FxPro offers transparent pricing, so traders always know the cost of entering and exiting positions. Tight spreads, combined with fast execution speeds, ensure that traders can react quickly to market movements and implement strategies without hidden charges affecting profitability.

Leverage Options

Leverage at FxPro allows traders to increase their exposure to the markets, providing the potential for amplified returns on smaller capital investments. The broker offers maximum leverage of up to 1:500 for select asset classes, depending on the trader’s account type and regulatory region. This level of leverage is particularly attractive for experienced traders who want to maximize their trading potential, especially in volatile markets.

However, leverage is a double-edged sword. While it can increase potential profits, it also magnifies potential losses, making risk management critical. FxPro encourages traders to use leverage wisely, providing access to tools such as stop-loss orders, take-profit levels, and margin calculators to help control risk. By carefully managing leverage, traders can pursue more ambitious trading strategies without exposing themselves to unnecessary financial danger.

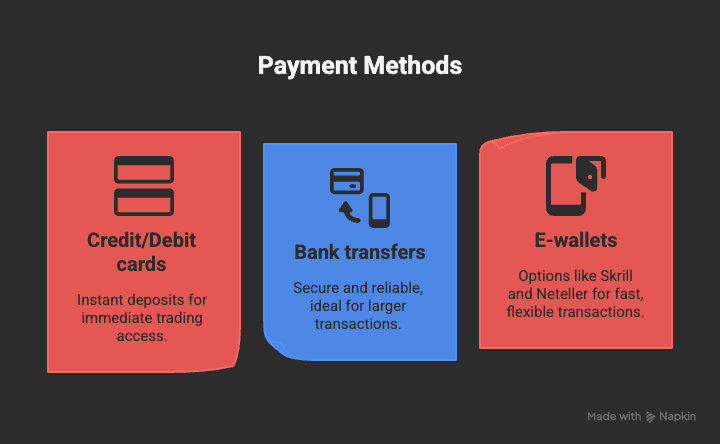

Payment Methods

- FxPro supports a broad range of secure and convenient deposit and withdrawal methods, making account funding and profit access simple for traders worldwide. Supported methods include:

- Credit/Debit cards – Instant deposits for immediate trading access.

- Bank transfers – Secure and reliable, ideal for larger transactions.

- E-wallets – Options like Skrill and Neteller for fast, flexible transactions.

Withdrawals are generally processed within 1–3 business days, depending on the method used. While some fees may apply depending on the payment channel, FxPro maintains a transparent policy to ensure traders know exactly what to expect. The broker’s efficient deposit and withdrawal system, combined with multiple funding options, ensures that managing trading funds is straightforward, allowing traders to focus on strategy rather than logistics.

FxPro’s flexible and transparent approach to spreads, leverage, and payments ensures that traders of all experience levels can access the tools they need while maintaining control over costs, risk, and liquidity. This comprehensive setup positions FxPro as a reliable and versatile broker in the competitive trading landscape.

Customer Support

- Support is available via:

- Phone

- Live Chat

- Support hours: 24/5. Multilingual service available. Premium account holders receive priority access and faster resolution times.

Final Verdict

FxPro stands out as a versatile and reliable broker, catering to traders of all experience levels. With a robust suite of trading platforms—including its proprietary web-based platform, MetaTrader 4, MetaTrader 5, and cTrader—FxPro provides tools that accommodate both beginners seeking simplicity and advanced traders requiring sophisticated analysis and automation capabilities.

The broker’s competitive trading conditions, featuring low spreads, flexible commission structures, and high leverage options, allow traders to optimize their strategies while maintaining control over costs and risk. Additionally, FxPro’s wide range of secure payment methods ensures seamless access to funds, enhancing convenience and reliability for global clients.

Regulated by top-tier authorities and committed to transparency, FxPro combines professional-grade technology with strong oversight, making it a trustworthy choice in a crowded broker landscape. Whether you are a beginner exploring forex or an experienced trader pursuing complex strategies, FxPro offers the tools, flexibility, and support necessary to trade confidently and effectively.

Now You Know More! Ready to Get Started?

Open an account with a trusted broker and start your trading journey today.

Now You Know More! Ready to Get Started?

Open an account with a trusted broker and start your trading journey today.

Frequently Asked Questions

FxPro is a global online broker offering trading in forex, CFDs, indices, commodities, stocks, and cryptocurrencies. The broker provides multiple trading platforms, competitive spreads, and strong regulatory oversight, making it suitable for both beginner and professional traders.

FxPro offers several platforms to meet different trading needs:

- Proprietary FxPro Web Platform: User-friendly interface with real-time charts and indicators, ideal for beginners.

- MetaTrader 4 & 5 (MT4/MT5): Advanced tools, automation, and Expert Advisors for professional traders.

- cTrader: Tight spreads and advanced features for active traders and scalpers.

FxPro provides a variety of accounts tailored to trading style and platform preference. MT4 and MT5 accounts are mostly commission-free, while cTrader accounts include a small commission but benefit from tighter spreads.

Spreads start from as low as 0.6 pips depending on the account type and instrument. MT4 and MT5 accounts are generally commission-free, whereas cTrader accounts charge a small commission that is offset by tighter spreads.

FxPro offers leverage up to 1:500 on select asset classes. Leverage allows traders to amplify potential returns, but it also increases risk, so proper risk management is essential. Margin requirements depend on your account type and region.

- Credit/Debit cards

- Bank transfers

- E-wallets such as Skrill and Neteller

Yes. FxPro is regulated by top-tier authorities, ensuring that client funds are protected and that trading practices are transparent and secure.

Absolutely. FxPro’s proprietary web platform and educational resources are tailored for beginners, while more advanced traders can utilize MT4, MT5, or cTrader for complex strategies.

FxPro offers a wide range of assets, including forex pairs, indices, commodities, stocks, metals, and cryptocurrencies.

Yes, FxPro may charge an inactivity fee if an account remains dormant for a certain period. It’s important to review the broker’s fee schedule to understand all potential charges.