Admirals Review 2025

Explore the features and offerings of Admirals, an established leader

in the multi-asset trading space.

Introduction

Choosing the right broker is essential for every trader — whether you’re a beginner entering the forex market for the first time or a professional managing a diversified investment portfolio. Admirals (formerly Admiral Markets), a highly trusted and multi-regulated brokerage launched in 2001, has gained global recognition for its extensive market access, advanced MetaTrader tools, and premium investor education.

In this in-depth Admirals review for 2025, we examine the broker’s regulation, fees, platforms, account types, security, and overall trading experience to help you decide if it’s the right fit for your goals.

Overall Rationg

4.5

Why Choose Admirals?

Admirals brings together cutting-edge MetaTrader technology, competitive spreads, comprehensive research tools, and robust regulation, making it one of the most well-rounded brokers available in 2025. Traders benefit from 8,700+ instruments, powerful MT4/MT5 add-ons, and indemnity insurance coverage up to €100,000 per client.

Broker Overview

Min. Deposit

$100

Available Assets

$8,702

Account Type

Trade.MT5, Invest.MT5, Zero.MT5

Education Materials

Courses, eBooks, Webinars, Market Insights

Deposits & Withdrawals

Instant deposits, withdrawals processed within 1–3 business days

Customer Service

24/5 multilingual support via email, phone, and live chat

Asset Classes

Forex, Stocks, Commodities, Indices, ETFs, Cryptocurrencies

Regulation

Regulated by ASIC, FCA, CySEC, JSC, FSCA, and others

Security

SSL encryption, Two-Factor Authentication, segregated client funds, indemnity insurance

Regulation & Security

Learn about Admirals regulatory complience and security measures.

Security

SSL encryption, Two-Factor Authentication (2FA), Segregated client funds, Indemnity insurance coverage from Lloyd’s of London up to €100,000 per client

When it comes to safety, Admirals is considered Highly Trusted with a Trust Score of 93/99.

Regulations

ASIC (Australia), FCA (UK), CySEC (Cyprus), JSC (Jordan)

Regulated broker ensuring compliance with international standards

Pros & Cons

Learn about Admirals regulatory complience and security measures.

Pros

- Packed with advanced MetaTrader upgrades & Supreme add-ons

- Access to over 8,700 instruments including stocks, ETFs, and CFDs

- Competitive spreads from 0.8 pips on EUR/USD

- Comprehensive investor education with courses and webinars

- Indemnity insurance and strong regulatory coverage

Cons

- Limited social trading features compared to competitors

- Inactivity fees can affect small or inactive accounts

- Mobile app less refined than top-tier alternatives

Broker Features at a Glance

Key features of top review brokers.

Trading Platform

MetaTrader 4 & 5 with Supreme add-ons, web-based platform

Asset Selection

Over 8,700 instruments across Forex, Stocks, ETFs, Indices, Commodities, and Crypto

Pricing & Leverage

Spreads from 0.8 pips, leverage up to 1:500 (varies by jurisdiction)

Risk Protection

Negative balance protection, volatility protection

Educational Resources

Academy, webinars, eBooks, and market analysis

Customer Support

24/5 multilingual live chat, phone, and email

Trading with Admirals: Platform Comparison

Proprietary MetaTrader Enhancements

Admirals offers MetaTrader Supreme Edition, a set of premium plug-ins for MT4/MT5 including Trading Central analytics, Acuity sentiment tools, and an economic calendar integrated directly into the platform.

MetaTrader 4 & 5

- MT4: Best for forex-focused traders

- MT5: Ideal for multi-asset trading, advanced order types, and depth of market features

Both platforms are available on desktop, web, and mobile.

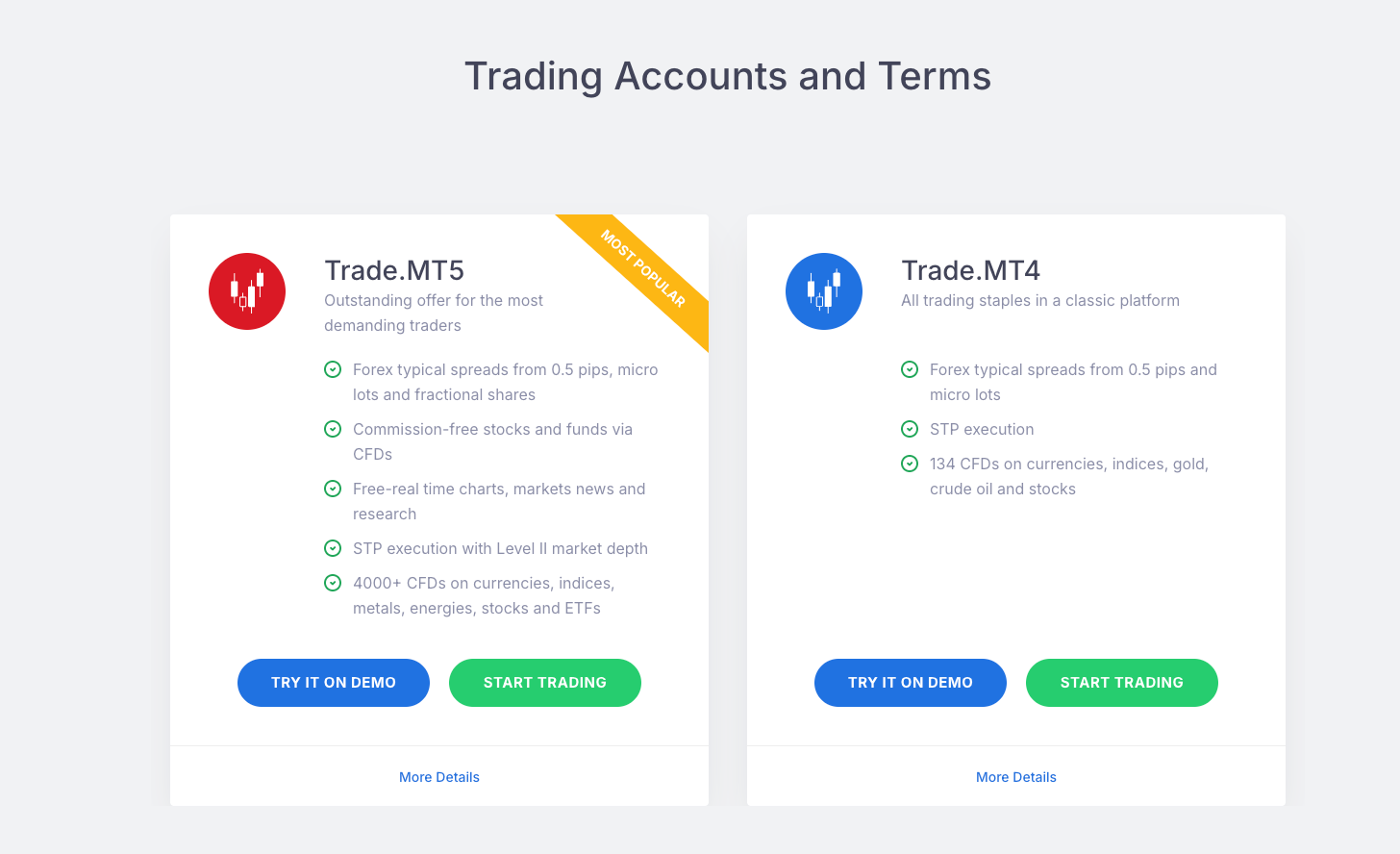

Account Types at Admirals

| Type | Min. Deposit | Spreads | Leverage | Key Features |

| Trade.MT5 | $100 | From 0.8 pips | Up to 1:500 | Standard trading, full MT5 features |

| Invest.MT5 | $1 | Commission from $0.02 per share | 1:1 | Invest in real stocks & ETFs |

| Zero.MT5 | $100 | From 0.0 pips (commission applies) | Up to 1:500 | Ideal for scalpers, tighter spreads |

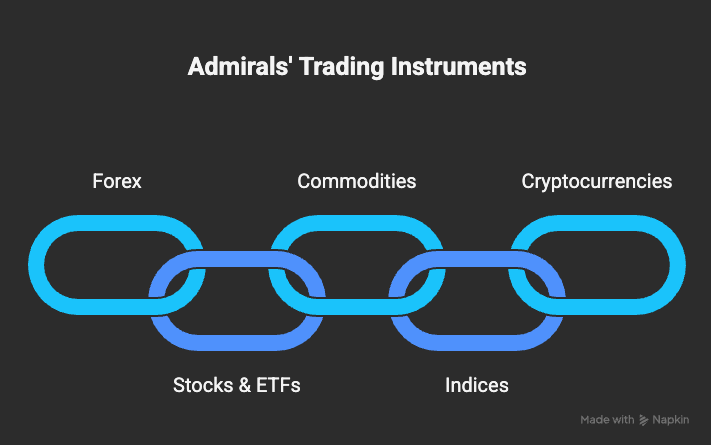

Trading Instruments

One of Admirals’ biggest competitive advantages is its exceptionally wide range of tradable instruments, catering to both short-term speculators and long-term investors. With access to over 8,700 financial products, Admirals allows traders to build diversified strategies across multiple asset classes, all from a single account.

Forex

Trade all major currency pairs such as EUR/USD, GBP/USD, and USD/JPY with competitive spreads. Minor pairs (e.g., AUD/NZD, EUR/GBP) and a wide selection of exotic pairs (e.g., USD/TRY, EUR/ZAR, USD/SGD) are also available for traders looking for niche opportunities and higher volatility plays.

Stocks & ETFs

Access over 4,500 real stocks from leading global exchanges, including the NYSE, NASDAQ, London Stock Exchange, and more. ETFs covering sectors like technology, energy, and healthcare are available for cost-effective portfolio diversification. Admirals also offers fractional share trading and automated recurring investments, allowing traders to gradually build equity positions over time.

Commodities

Hedge against inflation or capitalize on macroeconomic trends by trading commodities such as gold, silver, oil, and natural gas. Agricultural products like coffee, cocoa, and wheat are also included, offering exposure to the soft commodities market.

Indices

Trade leading cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), and more. Crypto CFDs allow traders to speculate on price movements without owning the underlying asset, and positions can be opened long or short.

Whether you are a forex day trader, a stock investor, or a commodities swing trader, Admirals provides the breadth of instruments needed to implement virtually any strategy.

Spreads & Commissions

Admirals offers a transparent and competitive pricing structure suitable for both cost-conscious traders and those who prioritize raw spreads for high-volume strategies.

- Trade.MT5 Account: EUR/USD spreads start from just 0.8 pips, with no added commissions, making it ideal for swing traders and long-term investors who value cost efficiency.

- Zero.MT5 Account: Designed for scalpers and day traders, this account offers raw spreads from 0.0 pips plus a fixed commission per lot traded. This structure ensures extremely tight pricing, which can be crucial for short-term strategies.

- Stock & ETF Commissions: Real stocks and ETFs are traded from as low as $0.02 per share on the Invest.MT5 account, making Admirals competitive for equity investing.

Other key points:

- No hidden fees on deposits and most withdrawals.

- Inactivity fee applies only after 24 months of account dormancy, giving traders flexibility.

- Swap rates (overnight financing) are clearly displayed on the platform, ensuring cost transparency.

This combination of tight spreads, flexible account types, and transparent fees allows traders to choose the cost model that best fits their style.

Payment Methods

Admirals supports a wide range of secure and convenient payment options, allowing traders to fund and withdraw from their accounts efficiently:

- Credit/Debit Cards: Instant processing for Visa and Mastercard transactions.

- Bank Transfer: Traditional funding method, suitable for larger deposits. Processing typically takes 1–3 business days.

- E-wallets: Fast and flexible options like Skrill, Neteller, and PayPal, often offering same-day processing.

- Local Payment Solutions: Depending on the trader’s region, Admirals may also support local payment gateways for ease of access.

Deposits are generally free of charge, while withdrawal fees depend on the chosen payment method. All transactions are processed using SSL encryption for maximum security.

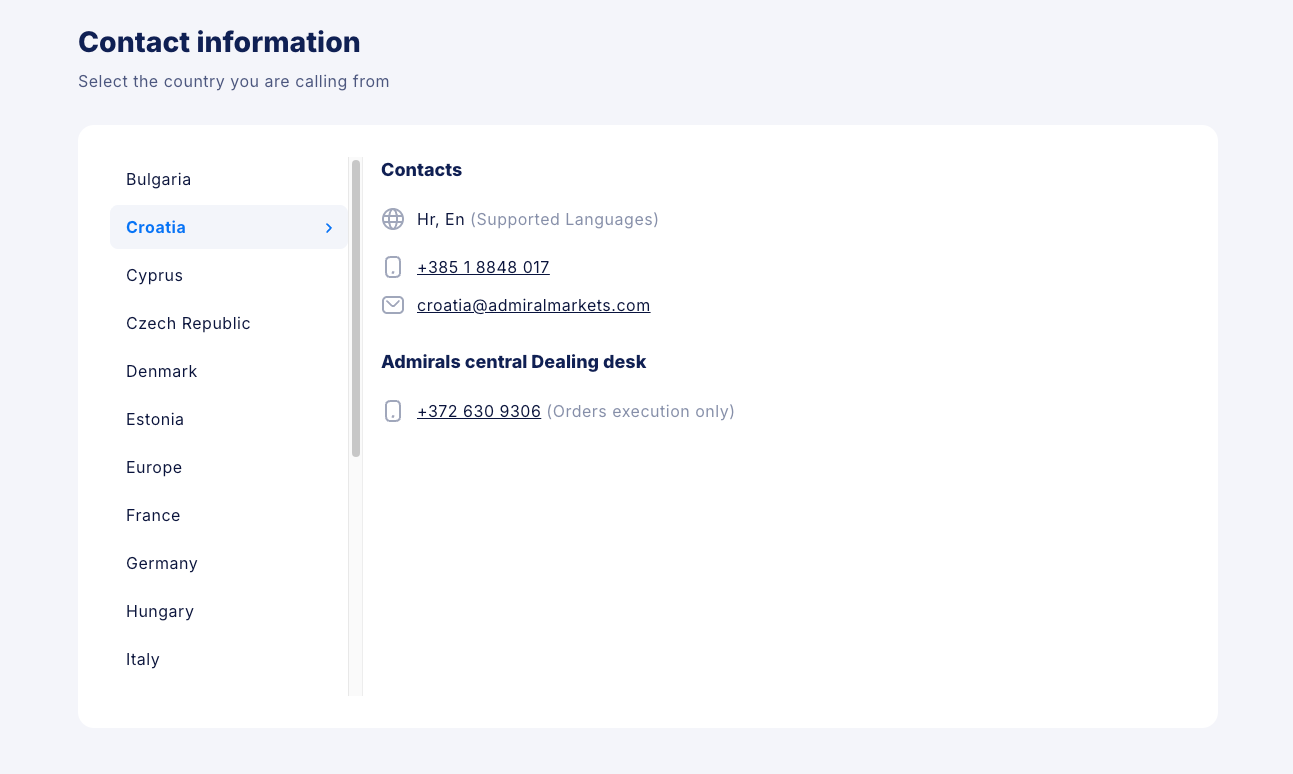

Customer Support

- Admirals has built a reputation for responsive, multilingual customer service aimed at resolving queries quickly and efficiently.

- Email Support: Ideal for formal queries or documentation requests, typically answered within 24 hours.

- Phone Support: Direct access to support teams during market hours for urgent issues.

- Live Chat: Real-time assistance available via the website and platform interface, allowing traders to get instant answers.

Availability:

- Support is offered 24 hours a day, 5 days a week in multiple languages, including English, Spanish, German, French, and more.

- Premium account holders benefit from priority support, which includes shorter wait times and dedicated account managers.

Whether you need technical assistance with MT5 settings, guidance on deposits, or help navigating market news, Admirals’ support team provides fast, professional, and reliable service.

Final Verdict

Admirals combines deep market access, robust regulation, and advanced trading tools into a package that appeals to both beginner and professional traders. With over 8,700 instruments, competitive spreads starting from 0.0 pips on Zero accounts, and powerful MetaTrader enhancements like the Supreme add-ons, it offers exceptional flexibility for any trading style.

Its strong regulatory standing across multiple Tier-1 jurisdictions — paired with indemnity insurance coverage up to €100,000 per client — ensures a high level of trust and security. Educational resources, fractional investing, and diverse funding options further enhance its appeal.

That said, traders should be mindful of inactivity fees and the broker’s limited social trading features. Mobile traders who demand the most polished app experience may also find competitors with more refined platforms.

Bottom Line: If you want a multi-regulated, secure, and feature-rich broker with one of the broadest market offerings in the industry, Admirals is a top choice for 2025. Whether you trade forex, CFDs, stocks, or crypto, Admirals gives you the tools and market depth to execute your strategy effectively.

Now You Know More! Ready to Get Started?

Open an account with a trusted broker and start your trading journey today.

Now You Know More! Ready to Get Started?

Open an account with a trusted broker and start your trading journey today.

Frequently Asked Questions

Yes. Admirals is considered Highly Trusted with a Trust Score of 93/99. It is regulated by multiple Tier-1 authorities including the FCA (UK), ASIC (Australia), and CySEC (Cyprus). Client funds are kept in segregated accounts, and traders are protected by indemnity insurance up to €100,000 per client.

The minimum deposit for most accounts is $100, while the Invest.MT5 account requires as little as $1.

Admirals supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5) with exclusive Supreme Edition add-ons that include Trading Central analysis, sentiment tools, and advanced charting features. Both platforms are available on desktop, web, and mobile.

Yes. Admirals provides crypto CFDs on popular coins like Bitcoin, Ethereum, Litecoin, Ripple, and more. These can be traded long or short without owning the underlying asset.

- Trade.MT5 account: Spreads from 0.8 pips, commission-free.

- Zero.MT5 account: Raw spreads from 0.0 pips + commission.

- Invest.MT5 account: Stocks from $0.02 per share. There are no deposit fees, and inactivity fees apply only after 24 months.

Professional clients can access leverage up to 1:500. Retail clients in regulated regions have lower limits, such as 1:30 for major forex pairs, in line with regulatory rules.

Funding methods include credit/debit cards, bank transfers, and e-wallets like Skrill, Neteller, and PayPal. Deposits are usually instant, and withdrawals are processed within 1–3 business days.

Yes. Admirals offers a rich educational suite including courses, webinars, market analysis, and eBooks. The broker is well-regarded for helping beginners improve their trading skills.

Absolutely. Admirals provides low entry requirements, comprehensive educational tools, and a user-friendly MetaTrader interface, making it an excellent choice for new traders.

You can register online by completing the application form, verifying your identity, and funding your account. The process is typically completed within 1–2 business days.