XM Review 2025

Explore the features and offering of XM Group, an established MetaTrader broker known for

its research tools and educational content.

Introduction

In today’s fast-paced trading landscape, selecting a reliable and well-regulated broker can significantly impact your success and experience in the markets. Whether you’re a first-time trader or a seasoned investor, the right platform should offer a balance of transparency, functionality, and support.

XM Group, established in 2009, has positioned itself as a globally recognized forex and CFD broker, known for its commitment to regulatory compliance, rich educational resources, and support for the full MetaTrader suite. With over 1,394 tradable instruments, low minimum deposit requirements, and multilingual customer support, XM caters to a broad spectrum of traders.

In this 2025 review, we take a closer look at XM’s platform features, account types, asset offerings, and more — helping you determine if it’s the right fit for your trading goals.

Overall Rationg

4.5

Why Choose XM Group?

XM Group offers tier-1 regulation, MetaTrader support, and a $5 minimum deposit.

Traders get access to 1,394+ instruments, daily analysis, and multilingual support.

With strong security features and education tools, XM suits all experience levels.

A trusted, research-driven broker, XM remains a top choice in 2025.

Who Should Trade with XM?

| Trader Type | Best Account | Reason* |

| Beginner | Micro | Small contract sizes, low risk entry |

| Cost-sensitive Day Trader | Ultra Low | Tight spreads, no commissions |

| Long-Term Investor | Shares | Physical equity trading with market pricing |

| Automated Strategy User | Any (MT4/MT5) | Full EA compatibility across MetaTrader platforms |

Compared to competitors like IC Markets (raw spreads) or eToro (social trading), XM holds a middle ground — offering wide accessibility, strong regulation, and exceptional education, but lacking advanced features or institutional-grade pricing.

Broker Overview

Min. Deposit

$5

Available Assets

1,394+ tradeable instruments including 55 forex pairs

Account Type

Micro, Standard, Ultra Low, Shares

Education Materials

Courses, eBooks, webinars, daily videos, podcasts

Deposits & Withdrawals

Instant deposits, withdrawals in 2–5 business days

Customer Service

24/5 multilingual support via email, phone, and live chat

Asset Classes

Forex, Stocks, Commodities, Indices, Crypto (via CFDs)

Regulation

Regulated by ASIC, CySEC, FCA, DFSA, and IFSC

Security

SSL encryption, 2FA, segregated client funds

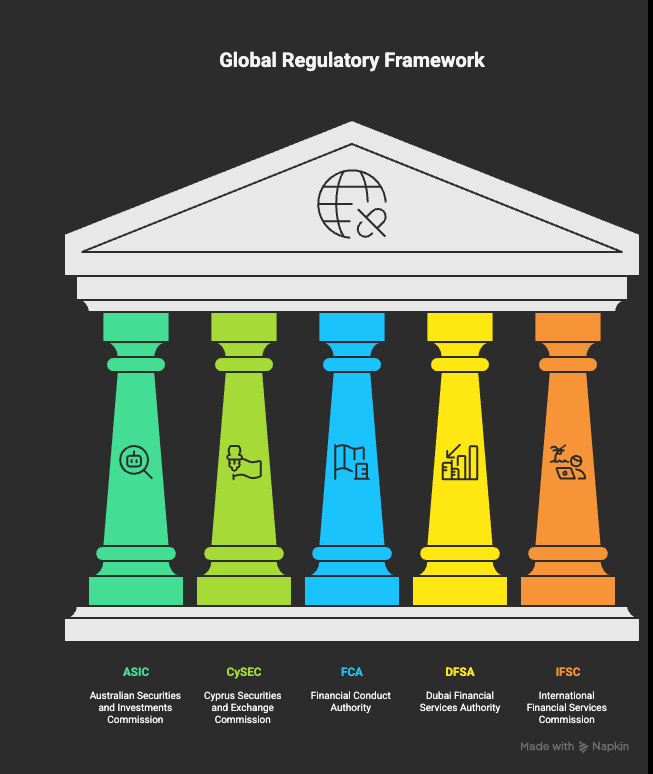

Regulation & Security

Learn about XM‘s regulatory complience and security measures.

Security

SSL encryption across platforms, Two-Factor Authentication (2FA), Segregated client funds, Negative balance protection for all retail clients

High level of security for your trading

Regulations

ASIC (Australia), CySEC (EU), FCA (UK), DFSA (UAE), IFSC (Belize)

Regulated broker ensuring compliance with international standards

Pros & Cons

Learn about Riverquode‘s regulatory complience and security measures.

Pros

- Beginner-friendly MetaTrader support

- Extensive educational tools including podcasts and live sessions

- Access to 1,394+ CFDs and 55 forex pairs

- In-depth daily research and technical analysis from Trading Central

- Low $5 minimum deposit

Cons

- No proprietary trading platform

- No published average spreads for Zero account

- Standard account spreads are less competitive

Broker Features at a Glance

Key features of top review brokers.

Trading Platform

Full support for MetaTrader 4 and MetaTrader 5 (desktop, web, mobile)

Asset Selection

Over 1,394 CFDs across Forex, Commodities, Indices, Stocks, Crypto

Pricing & Leverage

Variable spreads; leverage up to 1:500 (varies by region & asset)

Risk Protection

Negative balance protection

Education

Courses, webinars, videos, podcasts, eBooks, and live sessions

Support

24/5 multilingual support via phone, email, and live chat

Trading with XM: Platform Comparison

Proprietary Platform

Not available. XM relies exclusively on third-party platforms.

MetaTrader 4 / 5

XM offers full access to MT4 and MT5 — popular platforms among traders for their charting tools, automation (EAs), and reliability across devices.

XM Account Types – Which One Suits You?

XM Group offers a versatile range of account types designed to meet the needs of all trader levels — from complete beginners to advanced scalpers and investors. Each account offers a distinct combination of spreads, leverage, and trading conditions, with full access to MetaTrader 4, MetaTrader 5, and XM WebTrader.

All real accounts support negative balance protection, and most offer a swap-free (Islamic) option.

Account Overview

- Micro Account: Ideal for beginners or low-risk traders. Trade micro-lots (1,000 units) with just $5.

- Standard Account: Designed for traditional traders using standard lot sizes, also starting at $5.

- Ultra Low Account: Best for cost-conscious or high-frequency traders, with spreads from 0.6 pips.

- Zero Account: Tailored for scalpers with spreads from 0 pips and fixed commissions.

- Shares Account: Enables direct investment in real stocks without leverage, starting from $10,000.

- Islamic Account: Swap-free option available across all main accounts to comply with Sharia law.

- Demo Account: Practice trading with virtual funds in a risk-free simulated environment.

XM Account Types Comparison Table (2025)

| Account Type | Minimum Deposit | Spreads* | Commissions | Max Leverage | Min Trade Size | Base Currencies | Notes |

| Micro | $5 | From 1.0 pip | None | Up to 1:1000 | 0.01 lots (1,000 units) | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, SGD, ZAR | Beginner-friendly, trades in micro-lots |

| Standard | $5 | From 1.0 pip | None | Up to 1:1000 | 0.01 lots | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, SGD, ZAR | Traditional lot trading with no commissions |

| Ultra Low | $5 | From 0.6 pip | None | Up to 1:1000 | 0.01 lots | EUR, USD, GBP, AUD, ZAR, SGD | Lower spreads, suited for active traders |

| Zero | $5 | From 0 pip | Yes (per lot) | Varies | Varies | Major global currencies | Tightest spreads, fixed commission structure |

| Shares | $10,000 | Bid/ask only | Yes (by exchange) | 1:1 | 1 share | USD | Direct access to real stocks, no leverage |

| Islamic | Variable | Same as base | None (swap-free) | Same as base | Same as base | All supported | Available upon request, swap-free |

| Demo | None | N/A | N/A | N/A | N/A | N/A | Virtual funds, unlimited use for practice |

Trading Instruments

XM gives traders access to a diverse market range:

Forex

55 major, minor, and exotic currency pairs

Stocks

Global shares via CFDs and physical equity (Shares account)

Commodities

Gold, oil, agricultural products

Indices

Major global indices

Cryptocurrencies

CFD trading on popular coins like Bitcoin and Ethereum

Spreads & Commissions

XM Group offers a transparent pricing structure designed to suit a range of trading styles and experience levels. The Ultra Low account is best for traders prioritizing tighter spreads, offering rates from as low as 0.6 pips on major currency pairs, with no added commissions — ideal for scalpers and high-frequency traders.

The Standard and Micro accounts feature slightly wider spreads, starting from 1 pip, and are also commission-free, making them well-suited for beginners or those seeking simplicity in cost calculations.

For equity traders, the Shares account operates on market-based pricing, meaning spreads and commissions vary depending on the specific stock and market conditions. While this account type may come with higher minimum deposits and applicable trading fees, it allows direct access to physical equities, unlike the CFD-based instruments available on other account types.

Key Highlights

Ultra Low Account

- Spreads from 0.6 pips

- Commission-free

- Ideal for scalping and cost-sensitive strategies

Standard & Micro Accounts

- Spreads from 1 pip

- No added commissions

- Simple fee structure for beginners

Shares Account

- Market-based pricing

- Applicable commissions depending on the asset

- Direct access to physical stocks

Leverage Options

XM provides flexible leverage options tailored to different asset classes and trader profiles. The maximum leverage available is 1:500, allowing significant position sizes with minimal margin — particularly appealing to experienced traders with strong risk management practices.

However, leverage settings are subject to regional restrictions, regulatory limits, and account types. For example, clients under EU or ASIC regulation may be offered lower leverage in accordance with local compliance rules.

The Shares account does not provide leverage, as it is intended for trading real equities rather than leveraged CFDs.

To help protect retail clients from excessive risk, XM includes negative balance protection across all account types — ensuring that traders cannot lose more than their deposited funds, even during high market volatility.

Key Highlights

Maximum Leverage

Up to 1:500 depending on region, instrument, and account

Shares Account

No leverage, as it’s for physical stock trading

Region-Based Limits

Lower leverage may apply in EU/ASIC-regulated regions

Risk Management

Negative balance protection for all retail clients

Payment Methods

XM supports a diverse range of payment methods for both deposits and withdrawals, allowing clients worldwide to fund their accounts with ease and convenience. Supported methods include:

Credit/Debit Cards

Visa and Mastercard accepted for instant deposits

Bank Transfers

Suitable for larger transactions or clients in jurisdictions without card access

E-Wallets

Popular services like Skrill and Neteller offer fast, digital processing

Local Payment Solutions

Depending on your region, XM may support localized methods such as mobile payments, instant banking, or regional gateways

Processing times are highly efficient:

Deposits

Deposits are usually instant across all supported methods

Withdrawals

Withdrawals typically take 2–5 business days for cards and bank wires, while e-wallet withdrawals are often processed within 24 hours

Fees: XM does not charge deposit or withdrawal fees, though third-party providers may apply charges, especially in the case of bank wires or currency conversion.

This flexible and fee-free funding model enhances accessibility and helps ensure traders retain more of their capital for trading.

Accepted Methods

- Credit/Debit Cards (Visa, Mastercard)

- Bank Transfers

- E-wallets (e.g., Skrill, Neteller)

- Local payment options (varies by country)

Processing Times

Deposits

Typically instant across most methods

Withdrawals

2–5 business days for cards/banks

Within 24 hours for e-wallets

Fees

- XM charges zero deposit or withdrawal fees

- Third-party fees may apply for some methods (e.g., bank transfers)

Education & Research: Best in Class for Beginners

XM excels in structured education:

- Live webinars (multi-language)

- Daily market analysis (text & video)

- Trading Central integration for advanced insights

- Interactive eBooks, podcasts, and courses

Customer Support

Support is available via: Email, Phone and Live Chat.

Hours: 24/5 multilingual support

Extras: Premium users enjoy faster support and account management services.

Final Verdict: Is XM Right for You?

XM Group remains a top-tier choice for traders who value education, regulation, and MT4/MT5 flexibility. It excels in accessibility — with low minimum deposits and multilingual resources — making it especially well-suited to new and intermediate traders.

However, those looking for raw spreads, advanced tools, or a proprietary platform may prefer alternatives like IC Markets, Pepperstone, or Plus500.

Recommended For

- Beginners looking to learn and trade affordably

- Day traders seeking low-cost CFD access

- Investors outside the EU/UK who can access full leverage & bonuses

Not Ideal For

- Traders needing advanced order types or proprietary tools

- Those wanting ECN pricing with raw spreads

Now You Know More! Ready to Get Started?

Open an account with a trusted broker and start your trading journey today.

Now You Know More! Ready to Get Started?

Open an account with a trusted broker and start your trading journey today.

Frequently Asked Questions

Yes, XM is regulated by multiple top-tier authorities, including the FCA (UK), ASIC (Australia), CySEC (EU), DFSA (UAE), and IFSC (Belize). It offers key client protections like negative balance protection, segregated funds, and two-factor authentication.

No. XM does not accept U.S. residents or citizens due to regulatory restrictions.

XM offers full support for MetaTrader 4 (MT4) and MetaTrader 5 (MT5) across desktop, web, and mobile devices. It does not offer a proprietary platform.

The minimum deposit starts at $5 for Micro and Standard accounts. The Ultra Low account requires $50, and the Shares account starts at $10,000.

XM’s Micro, Standard, and Ultra Low accounts are commission-free. The only costs are spreads. The Shares account may include trading fees based on the instrument.

XM offers up to 1:500 leverage, but actual limits depend on your account type and regulatory jurisdiction. For example, EU and ASIC-regulated clients may only access leverage up to 1:30.

Yes. XM permits both scalping and hedging on all trading accounts.

Yes, XM provides free demo accounts with virtual funds. These are ideal for beginners or for testing strategies on MT4 or MT5.

XM does not charge deposit or withdrawal fees. However, third-party charges (e.g., bank transfer or currency conversion fees) may apply.

Yes, but only in eligible regions. XM offers deposit bonuses, loyalty rewards, and demo contests in jurisdictions where such promotions are allowed. Traders under FCA, CySEC, or ASIC regulation cannot receive bonuses due to compliance rules.