Choosing the Right Forex Broker: A Comprehensive Guide

Choosing the Right Forex Broker: A Comprehensive Guide

The forex market is the largest and most liquid financial market in the world, with a daily trading volume exceeding $6 trillion. Whether you’re a beginner or an experienced trader, selecting the right forex broker is crucial to your success. A reliable broker ensures fair pricing, secure transactions, and access to essential trading tools.

In this guide, we’ll explore the key factors to consider when choosing a forex broker, the different types of brokers, regulatory requirements, how to assess a broker’s reputation, and the pros and cons of demo vs. real accounts.

Key Factors to Consider When Choosing a Forex Broker

Selecting the right forex broker requires careful evaluation of several critical factors that can impact both short-term performance and long-term trading success:

A. Regulation and Licensing

Why It Matters: A regulated broker is legally bound to uphold transparent and secure trading practices. Regulatory oversight helps ensure that client funds are held in segregated accounts, protects against broker insolvency, and enforces ethical operational standards.

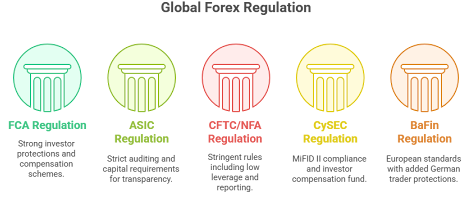

- FCA (UK) – Financial Conduct Authority: One of the most trusted regulators with strong investor protections and compensation schemes up to £85,000 under the FSCS.

- ASIC (Australia) – Australian Securities and Investments Commission: Ensures strict auditing and capital requirements. Brokers regulated under ASIC are known for transparency and integrity.

- CFTC/NFA (USA) – Commodity Futures Trading Commission / National Futures Association: US regulators enforce some of the most stringent rules, including low leverage limits and extensive reporting.

- CySEC (Cyprus) – Cyprus Securities and Exchange Commission: A popular regulator in the EU with MiFID II compliance and an Investor Compensation Fund. BaFin (Germany) – Federal Financial Supervisory Authority: Upholds European regulatory standards with added protections for German traders.

- BaFin (Germany) – Federal Financial Supervisory Authority: Upholds European regulatory standards with added protections for German traders.

Tip: Always verify a broker’s regulatory license on the official regulator’s website.

B. Trading Costs and Spreads

Spreads: The spread is the difference between the bid and ask price. Lower spreads mean reduced trading costs, especially for scalpers and day traders. Brokers offering floating (variable) spreads may offer tighter rates but can widen spreads during volatile conditions.

Commissions: Some brokers, particularly ECN brokers, charge a fixed commission per lot traded. While spreads are often tighter in these accounts, the commission adds to the total cost per trade.

Overnight Fees (Swap Rates): These are interest charges for holding positions overnight. Rates vary by broker and currency pair and can significantly impact long-term strategies like swing trading or position trading.

Other Fees: Watch for inactivity fees, withdrawal charges, and account maintenance fees. A transparent fee structure is a good sign of a reputable broker.

C. Trading Platform and Tools

MetaTrader 4 (MT4) & MetaTrader 5 (MT5): These platforms offer powerful charting, technical analysis, algorithmic trading (via Expert Advisors), and a user-friendly interface. MT5 also supports more order types and timeframes than MT4.

cTrader: Favored by ECN traders for its direct market access, depth-of-market display, and faster execution. Offers robust tools for professional traders.

Proprietary Platforms: Some brokers build their own platforms, which may include unique features such as integrated research, social trading, or advanced risk management tools. Evaluate usability, stability, and customizability.

Tools to Look For

- Economic calendars

- Autochartist or Trading Central integration

- Risk management calculators

D. Account Types and Leverage

Standard, Mini, Micro Accounts: Different account types accommodate varying capital levels and trading goals. Mini and micro accounts allow traders to start with smaller investments.

Leverage: Leverage amplifies potential profits and losses. Regulated brokers in the EU, UK, and Australia offer maximum leverage of 1:30 for retail clients, while offshore brokers may provide 1:200, 1:400, or even 1:1000. Use leverage cautiously and understand margin requirements to avoid account blowouts.

Islamic (Swap-Free) Accounts: These accounts comply with Sharia law and are available from many brokers upon request.

E. Deposit and Withdrawal Methods

Payment Options: The best brokers offer a wide array of funding options, including:

- Bank wire transfers

- Credit/debit cards

- E-wallets (Skrill, Neteller, PayPal)

- Cryptocurrencies (e.g., Bitcoin, USDT)

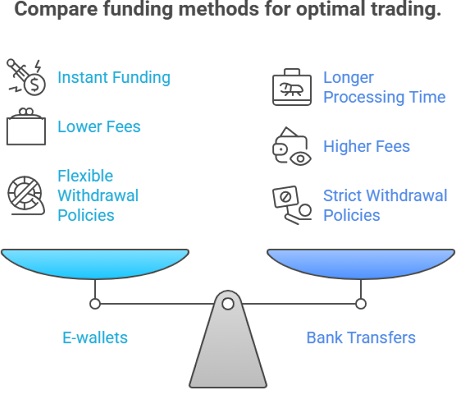

Processing Time: E-wallets usually offer instant or same-day funding, while bank transfers may take 2–5 business days. Check both deposit and withdrawal processing times.

Fees: Some brokers cover transaction costs; others charge fees, especially for international wire transfers or crypto withdrawals. Also, ensure there are no hidden currency conversion fees.

Withdrawal Policies: Review minimum withdrawal amounts, identity verification processes, and whether funds must be withdrawn via the same method used for deposit.

F. Customer Support

Availability: 24/5 support is the industry standard, but 24/7 service is increasingly common, especially for brokers offering crypto trading over the weekend.

Support Channels:

- Live chat for immediate assistance

- Email for documentation and follow-ups

- Phone support for urgent issues

- Multilingual support for non-English speakers

Knowledge Base: Check if the broker has an extensive FAQ section, help center, or live webinars to guide beginners and experienced traders alike.

G. Asset Selection

Forex Pairs: Ensure access to a broad range of currency pairs:

- Majors: High liquidity pairs like EUR/USD, GBP/USD, USD/JPY

- Minors: Cross-currency pairs like EUR/GBP or GBP/JPY

- Exotics: Emerging market currencies like USD/TRY or USD/ZAR, often more volatile

CFDs (Contracts for Difference): Many forex brokers offer access to other financial instruments:

- Stocks (e.g., Apple, Tesla)

- Indices (e.g., S&P 500, DAX)

- Commodities (e.g., Gold, Oil)

- Cryptocurrencies (e.g., Bitcoin, Ethereum)

Why It Matters: A diverse product offering enables you to hedge positions, diversify your portfolio, or explore new strategies across different markets—all within the same platform.

Types of Forex Brokers: ECN, STP, and Market Maker

A. ECN Brokers (Electronic Communication Network)

- How They Work: Connect traders directly with liquidity providers (banks, hedge funds).

- Pros: Tight spreads, no conflict of interest, transparent pricing.

- Cons: Higher commissions, requires larger capital.

B. STP Brokers (Straight Through Processing)

- How They Work: Route orders directly to liquidity providers without a dealing desk.

- Pros: No requotes, faster execution, lower spreads than market makers.

- Cons: Slightly wider spreads than ECN.

C. Market Makers

- How They Work: Act as counterparties to traders, setting their own prices.

- Pros: Fixed spreads, beginner-friendly, often offer bonuses.

- Cons: Potential conflict of interest, possible requotes.

Regulation and Licensing of Forex Brokers

Proper regulation is one of the most critical elements to examine when selecting a forex broker. Regulation ensures a broker operates under a legal framework that enforces financial transparency, accountability, and client protection. Here’s what traders need to know:

Why Regulation Matters

1. Fund Security: Regulated brokers are required to keep client funds in segregated bank accounts, separate from the broker’s operational funds. This prevents the broker from using your money for business expenses or speculative investments and ensures funds are retrievable in the event of insolvency.

2. Fair Trading Environment: Licensed brokers must follow strict rules that prohibit unethical practices like:

- Stop-hunting (triggering your stop-losses unfairly)

- Slippage manipulation (widening spreads during trades)

- Platform freezing during high volatility

They also use third-party liquidity providers, audited financial statements, and transparent trade execution policies to foster a level playing field for all traders.

3. Dispute Resolution: If a conflict arises, clients of regulated brokers can file complaints with the broker’s regulatory body. These authorities often provide structured complaint resolution procedures, including independent arbitration or compensation schemes.

For example:

- The FCA’s Financial Services Compensation Scheme (FSCS) can reimburse clients up to £85,000 in case of broker failure.

CySEC’s Investor Compensation Fund (ICF) offers protection up to €20,000.

Top Regulatory Authorities

Here are the most respected and trusted financial regulators worldwide:

- FCA (UK): Renowned for strict regulatory oversight and client protections.

- ASIC (Australia): Enforces capital adequacy, internal audits, and customer transparency.

- NFA/CFTC (USA): US brokers must adhere to tight leverage restrictions and high reporting standards.

- CySEC (Cyprus): Regulates many EU brokers under MiFID II, ensuring cross-border protections.

BaFin (Germany): Strong adherence to investor protection and AML policies.

Red Flags of Unregulated Brokers

1. Offshore Registration: Brokers registered in jurisdictions like Vanuatu, Belize, Saint Vincent and the Grenadines, or Marshall Islands often lack strong enforcement mechanisms. These regions offer low regulatory standards, enabling brokers to operate with minimal transparency.

2. Unrealistic Promises: Be cautious if a broker guarantees profits, offers high-leverage schemes with no downside, or advertises “zero-risk” trading. These claims are not only misleading but violate the marketing standards of regulated entities.

3. Withdrawal Issues: A major red flag is a broker making it difficult for traders to withdraw funds. Warning signs include:

- Sudden changes in withdrawal policies

- Delays without justification

- Requests for excessive documentation or extra fees before withdrawal

How to Verify a Broker’s License

Always verify a broker’s regulatory status by checking their license number against the official regulator’s website. For example:

- FCA Register

- ASIC Register

- CySEC Register

- NFA BASIC

Bottom Line: Trading with a regulated broker not only protects your capital but also provides a trustworthy trading environment. Avoiding unregulated brokers is one of the most effective ways to reduce your risk exposure in the forex market.

Evaluating the Reputation and Track Record of a Broker

The forex market is a vast, decentralized ecosystem composed of a wide range of participants, each with distinct objectives, trading volumes, and levels of influence. Understanding who these players are and how they interact is essential for grasping the dynamics of currency trading.

A. Online Reviews and Forums

- Trustpilot, Forex Peace Army: Check user feedback.

- Reddit, Trading Communities: Look for recurring complaints.

B. Years in Operation

- Established brokers (10+ years) are generally more reliable.

C. Awards and Recognitions

- Industry awards (e.g., "Best Forex Broker 2024") indicate credibility.

D. Demo Account Experience

- Test execution speed, spreads, and platform stability before committing.

Demo Account vs. Real Account: Pros and Cons

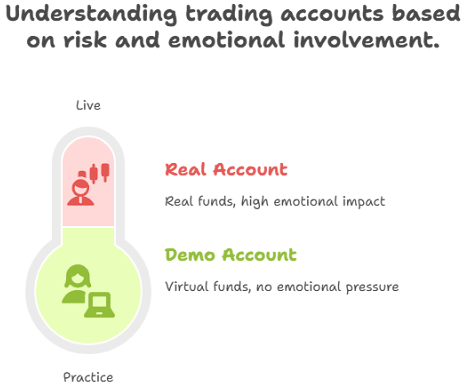

Feature | Demo Account | Real Account |

Funds | Virtual money (no risk) | Real money (potential profit/loss) |

Emotions | No psychological pressure | Emotional impact (fear, greed) |

Execution | May differ from real market conditions | Real-time spreads & slippage |

Purpose | Practice strategies, test platforms | Live trading with financial stakes |

Final Thoughts

Choosing the right forex broker is not a one-size-fits-all process. The ideal broker for you depends on your trading strategy, risk appetite, experience level, and long-term goals. Always prioritize regulation, cost efficiency, transparency, and technological reliability. A broker is your most critical partner in trading—choose wisely, and you’ll have a solid foundation for long-term success in the forex market.

Ready to Find the Best Forex Broker for You?

Don’t leave your trading success to chance. Explore our full breakdown of the Top 10 Best Forex Brokers in 2025 to compare features, fees, and platforms — and choose the one that fits your strategy.

Make your next trade with confidence — Start your broker comparison now.