Effective Forex Trading Strategies for Intermediate Traders (2025 Edition)

Effective Forex Trading Strategies for Intermediate Traders (2025 Edition)

Did you know the forex market sees , making it the largest financial market in the world? This massive, fast-paced forex market trading strategies landscape offers incredible opportunities in 2025, but success requires more than just luck or intuition.over $6 trillion in daily trading volume

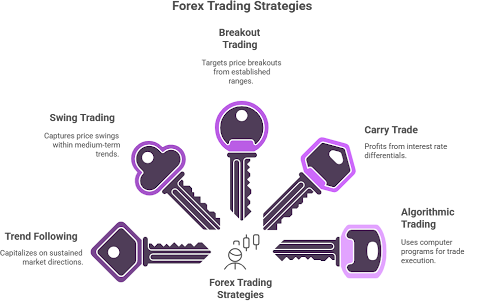

While the forex market operates 24/5 and presents numerous profit possibilities, it also comes with significant risks. That’s why effective forex trading strategies are essential for navigating this complex environment. From trend following and breakout trading to swing trading and algorithmic approaches, the best forex trading strategies adapt to changing market conditions and align with your personal trading style.

Importantly, no single strategy works for everyone. Throughout this guide, we’ll explore proven forex strategies for intermediate traders, helping you understand how to select advanced techniques that match your risk tolerance and schedule. We’ll also emphasize proper risk management—never risking more than 1-2% of your capital on a single trade—to ensure your long-term success in the dynamic world of currency trading.

Understanding Forex Strategy Types

Successful forex trading begins with understanding the different strategy types available to you. Each approach has distinct characteristics that make it suitable for particular trading styles, risk appetites, and time commitments. Let’s explore the core strategy categories that form the foundation of effective forex trading in 2025.

Short-term vs. long-term strategies

The timeframe you choose significantly impacts your trading approach and potential outcomes. Short-term strategies involve holding positions , whereas long-term strategies extend from weeks to months or even years.from minutes to a few days

Short-term trading includes:

- Scalping: Holding positions for minutes, targeting small but frequent profits

- Day trading: Completing trades within a single day, avoiding overnight exposure

Short-term trading offers quick profit realization, multiple earning opportunities during volatile periods, and minimized capital risk since incorrect positions can be quickly closed. However, these approaches come with higher trading costs due to frequent transactions, potential for significant losses during market volatility, increased stress levels, and greater time demands.

Long-term trading encompasses

- Swing trading: Holding positions for several days to weeks to capture price oscillations

- Position trading: Maintaining fewer trades over months or years for substantial gains

Long-term strategies require less monitoring time, create less stress, provide more profitable opportunities by riding winning trends, offer better cost-to-profit ratios, and allow easier trade adjustments when new economic data emerges. The primary challenges include requiring patience for positions to mature and deeper knowledge of fundamental analysis.

Technical vs. fundamental approaches

Forex trading strategies typically rely on two main analytical frameworks, often used in combination for maximum effectiveness.

Technical analysis examines historical price data and chart patterns to forecast future movements. This approach uses:

- Chart patterns (support/resistance levels, trend lines)

- Technical indicators (moving averages, momentum indicators)

- Volume analysis

- Oscillators for identifying overbought/oversold conditions

Technical analysts believe price charts contain all necessary information for trading decisions and that historical patterns tend to repeat. This approach works particularly well for short to medium-term trading timeframes.

Fundamental analysis evaluates economic, social, and political factors affecting currency supply and demand. Key components include:

- Economic indicators (GDP, employment figures, inflation rates)

- Interest rate decisions

- Trade balances

- Political stability and government policies

Fundamental analysts examine how macroeconomic conditions impact currency values, making this approach particularly valuable for longer-term strategy development. Position traders often rely heavily on fundamental analysis to identify undervalued currencies with growth potential over extended periods.

Manual vs. automated trading

How you execute trades represents another crucial strategy decision with significant implications for your trading experience.

Manual trading requires traders to personally monitor markets and make real-time decisions about entries and exits. This approach provides:

- Greater flexibility to adapt to unexpected market conditions

- Real-time control over decision-making

- Ability to incorporate intuition and experience

Nevertheless, manual trading demands substantial time commitment, exposes decisions to emotional biases like fear and greed, and limits the number of markets you can monitor simultaneously.

Automated trading employs to execute trades based on predetermined conditions without human intervention. Benefits include:pre-programmed algorithms

- 24/7 market monitoring capability

- Emotion-free execution following strict rules

- Faster order execution (milliseconds versus seconds for manual traders)

- Ability to backtest strategies on historical data before risking real capital

Despite these advantages, automated systems lack the adaptability of human traders during highly volatile or unpredictable market conditions and require technical expertise to develop and maintain.

The strategy types you select should align with your personal trading style, time availability, risk tolerance, and market knowledge. Most successful intermediate traders develop hybrid approaches that leverage elements from multiple strategy categories as their experience grows.

5 Effective Forex Trading Strategies for 2025

In the ever-evolving forex landscape, certain strategies stand out for their effectiveness across different market conditions. Let’s explore five proven approaches that continue to deliver results for intermediate traders in 2025.

1. Trend Following Strategy

Trend following capitalizes on the market’s tendency to move in sustained directions rather than attempting to predict future prices. This straightforward approach involves identifying established trends and “riding” them until they show signs of reversal.

The foundation of this strategy lies in the principle that “the trend is your friend.” Trend followers don’t aim to forecast specific price levels; they simply enter positions when they recognize a trend has formed based on their specific criteria. Common tools for identifying trends include:

- Moving averages (especially 50-day and 200-day combinations)

- Trendlines to visualize direction

- Price action patterns (higher highs/lows for uptrends, lower highs/lows for downtrends)

in strong, directional markets but struggles during sideways or choppy conditions. To implement this approach effectively, wait for a trend to fully establish before entering, and use trailing stop-losses to protect profits while letting winning positions run.Trend following performs best

2. Swing Trading Strategy

Swing trading captures price “swings” within medium-term trends, making it ideal for traders who can’t monitor markets constantly. This approach involves holding positions for several days to weeks, targeting the natural oscillations that occur even within broader trends.

Unlike day trading, swing trading doesn’t require constant attention—reviewing charts for a couple hours each evening is typically sufficient. Swing traders commonly employ:

- Support and resistance levels to identify potential reversal points

- Relative Strength Index (RSI) to spot overbought/oversold conditions

- Fibonacci retracements to identify potential pullback targets

One key swing trading approach involves buying at “swing lows” during uptrends and selling at “swing highs” during downtrends. Since positions are held longer, you’ll need larger stop losses to weather volatility, requiring disciplined money management.

3. Breakout Trading Strategy

Breakout trading targets moments when price “breaks out” of established trading ranges or consolidation patterns, potentially signaling the start of a new trend. This strategy works by entering the market right when price breaches support/resistance levels, riding the subsequent volatility.

Breakouts often represent the starting point for major price moves and volatility expansions. For effective breakout trading:

- Identify strong support/resistance levels—the longer they’ve held, the more significant the potential breakout

- Confirm breakouts with increased volume to filter out false signals

- Set stop-losses at logical levels (often just inside the broken support/resistance)

- Determine profit targets based on the height of the previous consolidation

Ready to Find the Best Forex Broker for You? Don’t leave your trading success to chance. Explore our full breakdown of the Top 10 Best Forex Brokers in 2025 to compare features, fees, and platforms — and choose the one that fits your strategy.

4. Carry Trade Strategy

The carry trade is a unique approach that profits from interest rate differentials between currencies rather than price movement alone. It involves borrowing in a low-interest-rate currency (funding currency) to invest in a high-interest-rate currency (asset currency).

For instance, if Japan’s interest rate is 0.5% and Australia’s is 4%, a trader might borrow Japanese yen, convert to Australian dollars, and invest in Australian securities, potentially earning the 3.5% difference. This strategy works best when:

- Interest rate differentials are wide

- Markets show low volatility

- Central bank policies are stable and predictable

The primary risk lies in exchange rate fluctuations—if the funding currency strengthens against the asset currency, gains from the interest differential can be quickly wiped out. Consequently, carry trades tend to perform best during periods of market complacency or optimism.

5. Algorithmic Trading Strategy

Algorithmic trading uses computer programs to execute trades based on predefined rules, removing emotion from decision-making and allowing for 24/7 market monitoring. This approach has gained significant popularity, with a substantial portion of global forex trades now executed by algorithms.

The benefits of algorithmic trading include:

- Consistent execution without emotional interference

- Faster reaction times than manual trading

- Ability to backtest strategies on historical data

- Simultaneous monitoring of multiple currency pairs

Popular algorithmic strategies include trend following, momentum trading, mean reversion, and arbitrage. To implement algorithmic trading, you’ll need reliable computer access, coding capabilities (or pre-built solutions like MT4), expert market knowledge, and robust risk management parameters.

How to Choose the Right Strategy for You

Finding the perfect forex strategy requires understanding yourself first. The ideal approach must align with your personal circumstances, trading psychology, and available resources to create a sustainable path to potential success.

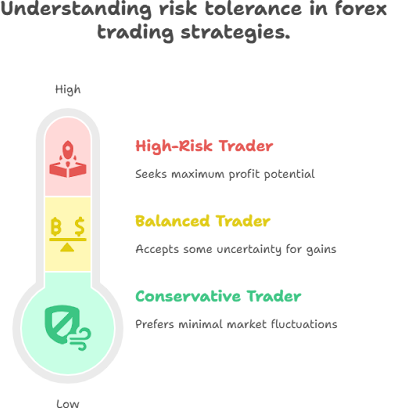

Assess your risk tolerance

Risk tolerance represents how much uncertainty you can handle in your trading journey. This personal trait varies significantly among traders based on financial situation, experience, and goals. Before selecting any forex market trading strategy, define your risk parameters clearly. A safe approach involves . Understanding your comfort level with market fluctuations helps develop a strategy tailored to your requirements.risking only 1-5% of your account balance per trade

Risk tolerance differs from risk capacity—the latter being your actual financial ability to absorb losses without affecting your lifestyle. Honest self-assessment through questionnaires or historical analysis of your previous trading behavior can reveal your genuine risk profile.

Match strategy to your time availability

Your daily schedule plays a critical role in determining which forex trading strategies will work for you. Day trading demands constant market monitoring, whereas position trading might only require checking charts once daily. According to experienced traders, certain approaches need you at your desk continuously, while others simply involve setting stop-loss and take-profit levels and letting positions run their course.

Evaluate realistically how many hours you can commit to trading. Those with limited availability should focus on longer timeframes and strategies requiring less active management.

Consider your trading experience

Your background knowledge influences which forex strategy suits you best. Traders with mathematics backgrounds often excel with technical analysis, while those versed in economics may prefer fundamental approaches. Programming skills could give you an edge with algorithmic trading strategies.

Most successful traders develop their preferred methods over time through consistent practice and refinement.

Use demo accounts to test strategies

Demo accounts provide invaluable risk-free environments to test forex trading strategies before risking real capital. With virtual funds (typically $50,000-$100,000), you can experiment with different approaches without financial consequences. These accounts accurately reflect real market conditions using live price quotes.

Through demo trading, you’ll discover which strategy matches your personality while gaining platform proficiency and building confidence. Test multiple approaches, analyze performance metrics like win/loss ratios, and refine your techniques accordingly.

Tools and Apps to Support Your Strategy

The right trading tools can dramatically improve your execution and analysis capabilities, transforming how you implement your forex market trading strategies. As markets evolve, so too must your toolkit.

Popular mobile trading apps

Mobile trading platforms have become essential for managing positions on the go. The FOREX.com mobile app offers advanced features including one-swipe trading, TradingView charts, and real-time trade alerts. Meanwhile, IG’s Trading app stands out with its intuitive layout and powerful charting capabilities with 33 technical indicators, earning it recognition as a top mobile platform. For traders seeking advanced functionality, Saxo’s SaxoTraderGO impresses with 64 chart indicators and synchronization between mobile and desktop versions.

Make your next trade with confidence — Start your broker comparison now.

Technical indicators to use

Technical indicators serve as analytical tools to guide entry and exit decisions:

- Moving Averages – Smooth out price action to identify broader trends

- Bollinger Bands – Measure volatility and identify potential breakout points

- RSI (Relative Strength Index) – Detect overbought/oversold conditions

- MACD – Measure momentum and identify potential trend changes

- Stochastic Oscillator – Compare current price to its range over time

Although backtesting shows the Ichimoku Kinko Hyo indicator delivered a 30.34% return over five years when used alone, most indicators perform better when combined. In fact, successful traders typically combine two to four complementary indicators rather than relying on a single signal.

Economic calendars and news alerts

Economic calendars track events that impact currency values. Forex Factory provides comprehensive event listings with expected impact levels clearly marked using color-coding (yellow, orange, or red bars). Additionally, FOREX.com’s calendar tracks unemployment figures, earnings reports, and election information that could affect markets. These tools help you avoid trading during potentially volatile news releases that could trigger substantial slippage.

Backtesting platforms for strategy validation

Before risking real capital, test your strategies on historical data. FX Replay allows you to simulate market conditions without seeing future price movements, mimicking live trading environments. TradingView offers both regular and deep backtesting options, plus Bar Replay for manually stepping through historical price action. Furthermore, platforms like ProRealTime provide paper trading capabilities that let you transition from backtesting to live market simulation without risk.

Risk Management for Intermediate Traders

Effective risk management forms the foundation of sustainable forex trading success. In essence, it’s the difference between surviving market turbulence and watching your account diminish.

Setting stop-loss and take-profit levels

First and foremost, stop-loss orders automatically close trades at predetermined price levels, protecting your capital when markets move against you. Take-profit orders, conversely, lock in gains when prices reach favorable levels. These exit orders work as a team to define your risk-reward parameters.

There are two primary stop-loss types:

- Standard stops that remain fixed at your specified price level

- Trailing stops that follow profitable positions, moving with favorable price action while remaining stationary during reversals

For optimal placement, position your stop-loss at points where your trade thesis is invalidated—typically beyond recent support or resistance levels. Your risk-reward ratio fundamentally impacts profitability. Generally, aim for a minimum 1:2 ratio; risking $100 to potentially gain $200 ensures even a 40% win rate can generate overall profits.

Managing leverage effectively

Leverage amplifies both gains and losses by allowing you to control larger positions with minimal capital. For instance, at 100:1 leverage, your money is amplified 100 times, meaning small market movements create proportionally larger impacts on your account.

Importantly, only risk 1-2% of your trading capital per position, even when using leverage. This prudent approach means you would need 50 consecutive losses to deplete your account at 2% risk per trade, versus just 10 losses at 10% risk.

Diversifying across currency pairs

Currency pairs often exhibit correlations, moving either together or inversely. Understanding these relationships helps control your portfolio’s overall exposure. For example, EUR/USD and USD/CHF typically move in opposite directions nearly 100% of the time, making simultaneous long positions in both equivalent to having virtually no position.

To diversify effectively, select pairs with varying correlations. This strategy reduces the impact of adverse movements in single pairs caused by unexpected news or price shocks. Moreover, central banks have different monetary policies, so diversification can protect against dollar fluctuations affecting all your positions equally.

Conclusion

Trading forex successfully requires more than just knowing different strategies—it demands applying them appropriately based on your personal circumstances. Throughout this guide, we’ve explored five powerful approaches that continue to deliver results for intermediate traders in 2025: trend following, swing trading, breakout trading, carry trade, and algorithmic trading.

Undoubtedly, the strategy you select must align with your risk profile, available time, and trading experience. A swing trading approach might work perfectly for someone with limited daily availability, whereas day trading suits those who can monitor markets continuously. Most importantly, remember that consistency with your chosen method typically yields better results than constantly switching between strategies.

Building your forex trading system takes time and patience. Therefore, start by testing potential strategies on demo accounts before risking real capital. This practice period allows you to refine your approach, identify strengths and weaknesses, and develop confidence in your decision-making process.

Additionally, the right combination of tools can significantly enhance your trading performance. Economic calendars help you avoid trading during volatile news releases, while technical indicators like RSI combined with MACD can provide stronger confirmation signals than either would alone. For instance, an RSI reading below 30 coupled with MACD line crossing above the signal line often presents a stronger buy signal during uptrends.

Above all, effective risk management forms the cornerstone of long-term forex trading success. Setting appropriate stop-loss levels, managing leverage prudently, and diversifying across currency pairs with varying correlations protects your capital during inevitable market fluctuations. Consequently, even strategies with 40% win rates can generate overall profits when implementing proper risk-reward ratios of at least 1:2.

The forex market will continue evolving, presenting both challenges and opportunities. Nevertheless, the fundamentals of successful trading remain constant: selecting suitable strategies, employing robust risk management, utilizing helpful tools, and maintaining psychological discipline. These elements, when combined thoughtfully, create a sustainable framework for navigating the dynamic world of currency trading.

Finally, approach your trading as an ongoing learning process rather than a get-rich-quick scheme. Each trade provides valuable lessons that help refine your approach over time. With dedication to continuous improvement and disciplined execution of your chosen strategies, you’ll position yourself for potential long-term success in the fascinating world of forex trading.

Frequently Asked Questions

Yes, forex trading remains profitable in 2025 for traders who invest in education, utilize appropriate technology, practice disciplined risk management, and adapt to changing market conditions. Success requires dedication to continuous learning and consistent application of effective strategies.

Some effective strategies for intermediate traders include trend following, swing trading, breakout trading, carry trade, and algorithmic trading. The best strategy depends on individual factors like risk tolerance, time availability, and trading experience.

Risk management is crucial for long-term success in forex trading. It involves setting appropriate stop-loss levels, managing leverage prudently, and diversifying across currency pairs. Proper risk management can help traders survive market turbulence and maintain consistent profitability.

Useful tools for forex traders include mobile trading apps for on-the-go management, technical indicators for analysis, economic calendars for tracking market-moving events, and backtesting platforms for strategy validation. These tools can significantly improve execution and analysis capabilities.

To choose the right strategy, assess your risk tolerance, consider your time availability, evaluate your trading experience, and use demo accounts to test different approaches. The ideal strategy should align with your personal circumstances, trading psychology, and available resources.

Ready to Find the Best Forex Broker for You?

Don’t leave your trading success to chance. Explore our full breakdown of the Top 10 Best Forex Brokers in 2025 to compare features, fees, and platforms — and choose the one that fits your strategy.

Make your next trade with confidence — Start your broker comparison now.