Forex Trading Basics: Essential Guide for Complete Beginners

Forex Trading Basics: Essential Guide for Complete Beginners

Forex trading stands at the heart of the global financial system, powering international commerce, investment, and speculation. With a daily turnover exceeding $5 trillion, the foreign exchange (forex) market is the largest and most liquid marketplace in the world, attracting participants from multinational banks to individual traders. This guide provides a deep dive into the fundamentals of forex trading, its historical evolution, the major currencies, essential trading concepts, and the diverse participants that shape the market.

What Is Forex Trading?

Forex trading, also known as foreign exchange trading or currency trading, is the process of exchanging one currency for another in a global decentralized market. The Forex market (short for “foreign exchange”) is the largest and most liquid financial market in the world, with a daily trading volume exceeding $7.5 trillion (as of 2024).

At its core, forex trading involves buying one currency while simultaneously selling another. These trades occur in currency pairs—for example, EUR/USD (Euro vs. U.S. Dollar) or GBP/JPY (British Pound vs. Japanese Yen).

What Is Forex Trading?

- High liquidity and accessibility

- 24/5 market operation (open from Sunday evening to Friday night)

- Low capital requirements for entry

- Potential to profit in rising or falling markets New to the markets? Learn Forex Trading: A Comprehensive Guide for Beginners to build your foundational knowledge.

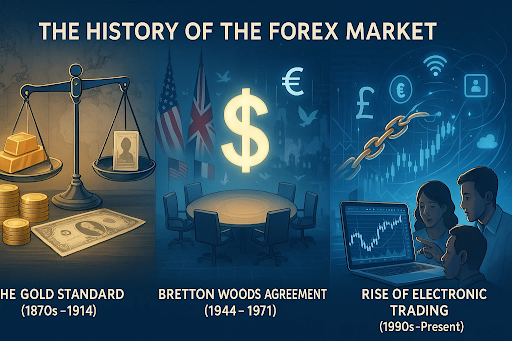

The History of the Forex Market

The evolution of the Forex market is closely tied to the development of global trade and monetary systems. Here’s a brief timeline:

1. The Gold Standard (1870s–1914)

Currencies were linked to a fixed amount of gold. This system created a stable exchange rate environment but lacked flexibility during crises.

2. Bretton Woods Agreement (1944–1971)

After World War II, the Bretton Woods system established the U.S. dollar as the global reserve currency, pegged to gold. Other currencies were tied to the dollar.

3. The Free-Floating Era (1971–Present)

In 1971, the U.S. ended the gold standard, giving rise to floating exchange rates. This shift marked the beginning of modern-day forex trading, with currency values determined by market forces.

4. Rise of Electronic Trading (1990s–Present)

The internet revolutionized forex by enabling retail traders to access the market through online brokers and platforms like MetaTrader, fostering massive market growth.

Major Currencies and Their Characteristics

Forex trading revolves around currency pairs, with certain currencies being more dominant due to their economic and political significance.

Top 7 Most Traded Currencies (2024)

Currency |

Country/Region |

Symbol |

Characteristics |

USD |

United States |

$ |

Global reserve, safe-haven, highly liquid |

EUR |

Eurozone |

€ |

Second most traded, backed by strong economies |

JPY |

Japan |

¥ |

Safe-haven, heavily influenced by monetary policy |

GBP |

United Kingdom |

£ |

Volatile, affected by political events (e.g., Brexit) |

AUD |

Australia |

A$ |

Commodity-driven, sensitive to Asian markets |

CAD |

Canada |

C$ |

Oil-linked, relatively stable |

CHF |

Switzerland |

Fr |

Safe-haven, low inflation, strong banking |

Currency Pair Categories

- Major Pairs: Include USD and another major currency (e.g., EUR/USD, GBP/USD)

- Minor Pairs: Do not include USD but involve major currencies (e.g., EUR/GBP)

- Exotic Pairs: Combine a major currency with one from an emerging economy (e.g., USD/TRY)

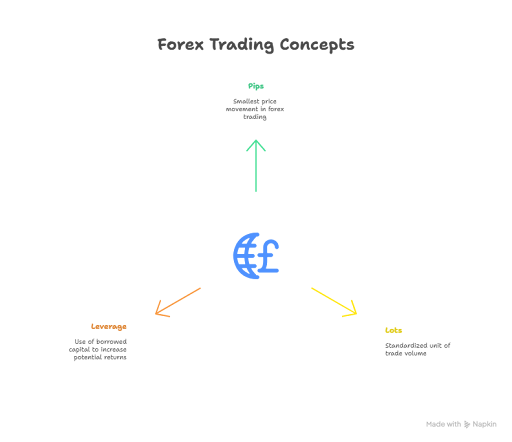

Basics of Forex Trading: Pips, Lots, and Leverage

To trade effectively, beginners must understand key forex terms that define pricing, volume, and potential risk.

What Is a Pip?

A pip (short for “percentage in point”) is the smallest standardized price movement in a currency pair, serving as the fundamental unit for measuring price changes and profit or loss.

- Standard Pip Size: For most currency pairs, one pip equals 0.0001 (one ten-thousandth of a unit).

Example: If the EUR/USD pair moves from 1.1050 to 1.1051, it has moved 1 pip.

- Exception (Japanese Yen pairs): For pairs involving the Japanese Yen (JPY), such as USD/JPY or EUR/JPY, one pip equals 0.01 (one hundredth).

Example: If USD/JPY moves from 110.25 to 110.26, that is a 1 pip movement.

Understanding pips is essential because they quantify price changes and help traders calculate gains or losses.

What Is a Lot?

A lot represents the standardized volume or size of a forex trade. It determines how many units of the base currency you are buying or selling.

- Standard Lot: 100,000 units of the base currency

- Mini Lot: 10,000 units (1/10th of a standard lot)

- Micro Lot: 1,000 units (1/100th of a standard lot)

Why are different lot sizes important?

Smaller lot sizes allow retail traders with limited capital to participate in the market and manage their risk more effectively. For example, trading micro lots reduces exposure and potential losses compared to standard lots.

What Is Leverage?

Leverage is a powerful tool that allows traders to control a much larger position than their actual invested capital by borrowing funds from their broker. Leverage limits vary by broker, so Choosing the Right Forex Broker: Key Criteria to Know is essential for understanding available margin, spreads, and trading conditions.

- Example: With 1:100 leverage, you can control $100,000 worth of currency by putting up only $1,000 as margin

Benefits and Risks

- Leverage amplifies profits when the market moves in your favor.

- However, it also magnifies losses, potentially exceeding your initial investment if not managed properly.

Regulatory Limits

To protect retail traders, regulatory bodies often impose leverage caps:

- European Union (ESMA): maximum leverage of 1:30 for major currency pairs

- United States (NFA/CFTC): maximum leverage of 1:50 for major pairs

Understanding Forex Market Participants

The forex market is a vast, decentralized ecosystem composed of a wide range of participants, each with distinct objectives, trading volumes, and levels of influence. Understanding who these players are and how they interact is essential for grasping the dynamics of currency trading.

1. Central Banks

Central banks are among the most influential participants in the forex market. Their primary goals are to manage national monetary policy, control inflation, stabilize the financial system, and support economic growth. Central banks like the U.S. Federal Reserve (Fed), European Central Bank (ECB), and Bank of Japan (BoJ) impact currency values through:

- Interest rate decisions: Raising rates generally strengthens a currency, while lowering rates can weaken it.

- Open market operations: Buying or selling government securities to control money supply.

- Quantitative easing: Injecting liquidity into the economy, often leading to currency depreciation.

- Currency interventions: Directly buying or selling their own currency to influence exchange rates

- Managing currency pegs and reserves: Maintaining fixed exchange rates or stabilizing currency values by adjusting foreign reserve.

Central bank announcements and policy shifts can trigger significant volatility in forex markets, making them critical to monitor for all traders.

2. Commercial Banks and Financial Institutions

Commercial banks are the backbone of the forex market, handling the majority of daily transactions. Their roles include:

- Facilitating currency exchange: Executing trades for corporate clients, investors, and governments.

- Speculative trading: Engaging in proprietary trading to profit from currency movements.

- Market making: Setting bid and ask prices, providing liquidity, and influencing price formation.

Major global banks such as JPMorgan Chase, Citigroup, and Deutsche Bank are key players, often trading billions of dollars daily and offering a wide range of forex products, including spot, forwards, and derivatives. Their activities not only support international commerce but also shape overall market trends.

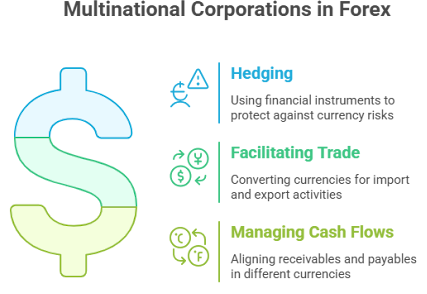

3. Multinational Corporations

Large companies operating across borders participate in the forex market primarily to manage risks associated with currency fluctuations. Their activities include:

- Hedging: Using financial instruments like forwards and options to protect against adverse currency movements that could impact profits or costs.

- Facilitating trade: Converting currencies for importing raw materials or exporting goods and services.

- Managing cash flows: Aligning receivables and payables in different currencies to minimize exposure.

Research shows that while some firms use “natural hedging” by matching foreign currency inflows and outflows, many rely on financial hedging—especially FX forwards—to manage their risk, particularly for large or short-term exposures. For example, a European manufacturer paying for U.S. raw materials will hedge its dollar exposure to avoid losses from currency swings.

4. Hedge Funds and Investment Managers

Hedge funds and investment managers are major speculative forces in the forex market. Many hedge funds rely on understanding market trends and patterns to identify high-probability trade setups and manage risk.

Their characteristics include:

- Large trading volumes: Often moving billions in and out of currencies for profit or portfolio diversification.

- Advanced strategies: Employing algorithmic trading, technical analysis, and macroeconomic research to identify opportunities.

- Long-term focus: Unlike retail traders seeking quick gains, hedge funds prioritize steady, compounded returns and disciplined risk management.

These participants are known for their agility and ability to exploit short-term inefficiencies, often amplifying market trends.

5. Retail Traders

Retail traders are individual investors who access the forex market via online brokers. Key features include:

- Accessibility: Platforms like MetaTrader 4/5 and cTrader enable individuals to trade global currencies with relatively small capital.

- Speculation: Most retail trading is speculative, aiming to profit from short-term price movements.

- Education and tools: Retail traders benefit from educational resources, demo accounts, and a variety of analytical tools, though they typically trade much smaller volumes than institutional players.

While retail traders account for a small fraction of total market volume, their numbers have grown rapidly due to technological advancements and the democratization of trading platforms.

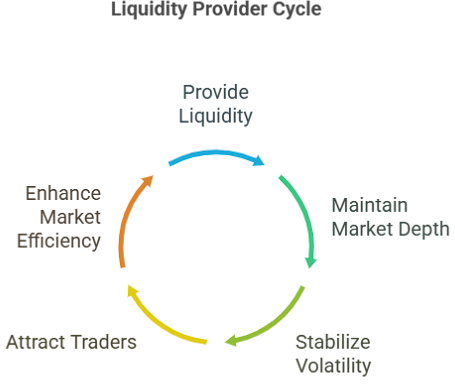

6. Brokers and Liquidity Providers

Brokers and liquidity providers serve as intermediaries, connecting retail and institutional traders to the broader forex market. Their roles include:

- Order execution: Facilitating trades on behalf of clients.

- Market making: Some brokers act as market makers, quoting prices and taking the opposite side of client trades, thereby providing liquidity.

- Access to interbank market: Brokers aggregate liquidity from multiple sources, ensuring competitive pricing and efficient order fulfillment.

Liquidity providers, often large banks or specialized firms, ensure the market remains deep and active, especially during volatile periods.

Final Thoughts

Forex trading is a dynamic, high-liquidity marketplace that underpins the global economy. Its history reflects the evolution of international finance, while its structure offers unparalleled opportunities and risks for traders of all sizes. By understanding the fundamentals of currency trading, the characteristics of major and exotic currencies, essential trading concepts like pips, lots, and leverage, and the diverse participants that drive the market, you are well-equipped to embark on your forex trading journey with confidence and clarity.

Frequently Asked Questions

Yes, forex trading is legal in most countries when conducted through a regulated broker.

Yes, many brokers allow micro-lot trading, enabling you to start with small capital. However, low balances limit risk tolerance and trading flexibility.

The London-New York overlap (8 AM – 12 PM EST) offers the highest liquidity and volatility.

Ready to Find the Best Forex Broker for You?

Don’t leave your trading success to chance. Explore our full breakdown of the Top 10 Best Forex Brokers in 2025 to compare features, fees, and platforms — and choose the one that fits your strategy.

Make your next trade with confidence — Start your broker comparison now.