FxPro Review

Is FxPro Worth It? A Comprehensive Broker Review

FxPro, established in 2006 and headquartered in London, has grown into a prominent online trading platform specializing in Contracts for Difference (CFDs) across six asset classes. Over the years, it has built a reputation for reliability, regulatory compliance, and a diverse range of trading instruments. This comprehensive review delves into FxPro’s offerings, assessing its strengths and potential drawbacks to help you determine if it’s the right broker for your trading needs.

Introduction to FxPro

FxPro is a leading online broker offering access to forex, commodities, indices, stocks, and cryptocurrencies. Catering to both retail and institutional traders, it provides advanced tools, competitive spreads, and multiple account types. Regulated by top-tier authorities like the UK’s Financial Conduct Authority (FCA) and Cyprus Securities and Exchange Commission (CySEC), FxPro ensures transparency and security. But what truly sets it apart? Let’s dive into its key features.

Key Features of FxPro

1. Strong Regulation and Security

FxPro operates under the stringent oversight of multiple financial authorities, including:

- The Financial Conduct Authority (FCA) in the United Kingdom

- The Cyprus Securities and Exchange Commission (CySEC)

- The Securities Commission of the Bahamas (SCB)

- The Financial Sector Conduct Authority (FSCA) in South Africa

This extensive regulatory framework ensures that FxPro adheres to high standards of transparency, integrity, and security, providing traders with a trustworthy environment.

2. Diverse Trading Instruments

FxPro offers a wide range of assets:

Asset Class | Available Instruments |

Forex | 70+ currency pairs, including majors, minors, and exotics. |

Cryptocurrencies | Bitcoin, Ethereum, Litecoin, and more. |

Commodities | Gold, silver, oil, and natural gas. |

Indices | S&P 500, NASDAQ, FTSE 100. |

Stocks | Shares from global markets (e.g., Apple, Tesla). |

Futures | Contracts on commodities and indices. |

3. Advanced Trading Tools

- Technical Analysis: Indicators and charting tools for market analysis.

- Economic Calendar: Real-time updates on key economic events.

- Risk Management: Stop-loss and take-profit orders to manage risk.

4. Competitive Pricing

- Raw Spreads: Starting from 0.0 pips on cTrader.

- No Hidden Fees: Transparent fee structure.

- Swap-Free Accounts: Sharia-compliant options.

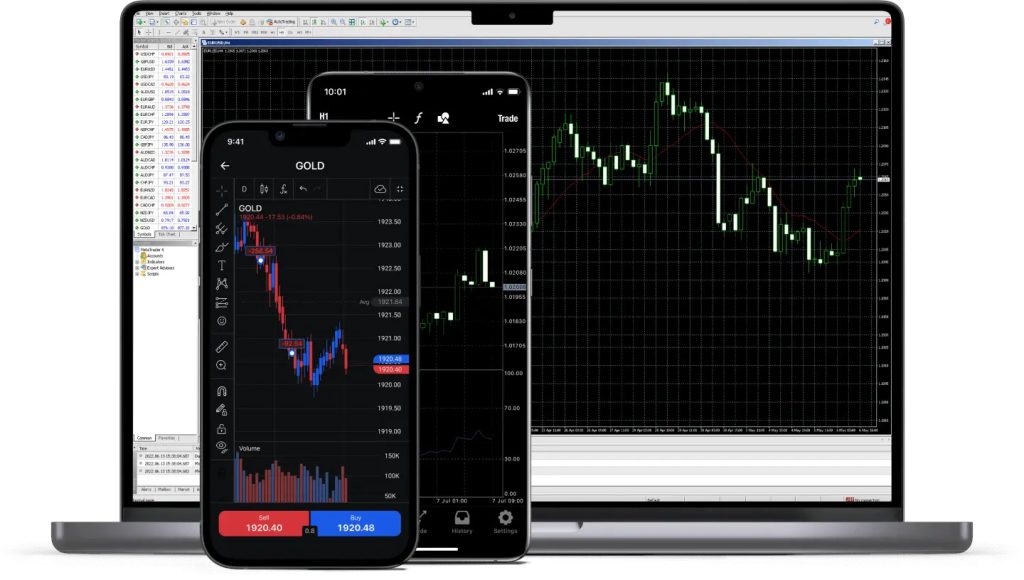

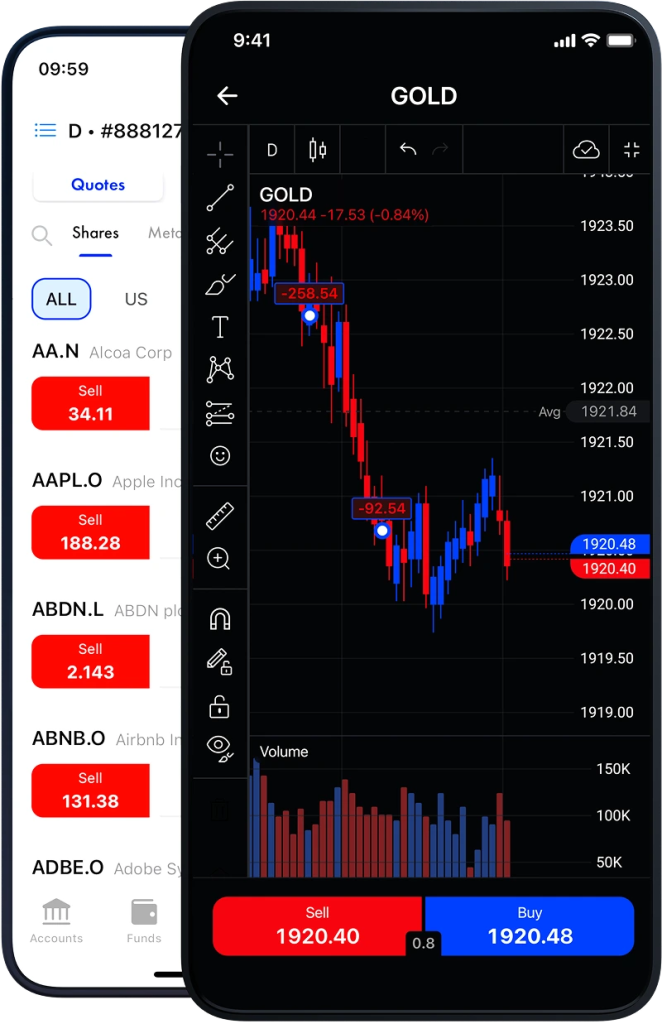

5. Multiple Trading Platforms

FxPro supports:

Trading Platform | Availability | Key Features |

MetaTrader 4 (MT4) | Desktop, Web, Mobile | User-friendly interface, advanced charting tools. |

MetaTrader 5 (MT5) | Desktop, Web, Mobile | Enhanced features, additional timeframes, economic calendar. |

cTrader | Desktop, Web, Mobile | Advanced order execution, depth of market (DOM). |

FxPro Platform | Desktop, Web, Mobile | Proprietary platform, seamless trading across devices. |

6. Multiple Account Types

FxPro offers tailored accounts:

Account Type | Minimum Deposit | Spreads | Leverage | Key Features |

MT4 Instant | $100 | From 0.6 pips | Up to 1:500 | Instant execution, ideal for beginners. |

MT4 Fixed | $100 | Fixed spreads | Up to 1:500 | Predictable costs. |

MT5 | $100 | From 0.6 pips | Up to 1:500 | Access to additional instruments. |

cTrader | $100 | From 0.0 pips | Up to 1:500 | Advanced execution, ideal for pros. |

7. Educational Resources

FxPro offers:

- Tutorials and Guides: From basics to advanced strategies.

- Webinars and Seminars: Insights from industry experts.

- Demo Account: Practice trading with virtual funds.

8. 24/7 Customer Support

FxPro provides responsive support via live chat, email, and phone, along with a detailed FAQ section.

Pros and Cons of FxPro

Pros

- Diverse Trading Instruments: Wide range of assets for portfolio diversification.

- Multiple Platforms: MT4, MT5, cTrader, and FxPro’s proprietary platform.

- Advanced Tools: Technical indicators, economic calendar, and risk management.

- Strong Regulation: FCA, CySEC, and FSCA oversight.

- Educational Resources: Comprehensive materials for skill development.

- 24/7 Support: Reliable and responsive customer service.

Cons

- Limited Crypto Options: Fewer cryptocurrencies compared to specialized exchanges.

- High Minimum Deposit for cTrader: $100 may deter some beginners.

- Inactivity Fees: Charges for dormant accounts.

Conclusion

FxPro is a dependable and versatile trading platform that balances advanced tools, security, and user-friendly design. While it may not cater to every niche, its strengths make it a strong option for many traders. As with any financial decision, thorough research and self-assessment are key to determining if FxPro aligns with your trading journey.