How to Choose a Forex Broker in 2025 – A Beginner’s Guide

How to Choose a Forex Broker in 2025 – A Beginner’s Guide

Choosing a reliable forex broker is the first and most crucial step in your trading journey. In 2025, where financial technology and regulatory standards have evolved, selecting the right broker means more than just tight spreads—it’s about security, transparency, and tools that support long-term success.

Whether you’re just starting or switching platforms, this guide breaks down the essential factors to help you choose a broker that aligns with your goals, risk tolerance, and trading style.

Spreads, Commissions & Fees: Know What You’re Paying For

Understanding how a broker charges for trades is key to long-term profitability. Even small differences in costs can compound over hundreds of trades, especially if you’re a high-frequency or intraday trader.

Spreads: The Core Trading Cost

- What is a Spread?

It’s the difference between the bid (selling) and ask (buying) price of a currency pair.

- What’s a Good Spread in 2025?

For major pairs like EUR/USD or GBP/USD, look for spreads starting from 0.0 to 1.5 pips. Lower spreads are especially important for scalpers and day traders who rely on tight margins.

- Fixed vs. Variable Spreads

- Fixed spreads remain constant but may be higher.

- Variable spreads change with market volatility—lower on average, but can widen during news events.

Commissions: Especially Common with ECN Brokers

- How They Work: Instead of widening the spread, some brokers (particularly ECN/STP) charge a flat commission per trade, such as $3 to $7 per standard lot.

- Evaluate the Trade-Off: A low spread with a commission can sometimes be cheaper than a high spread with no commission. Always calculate the all-in cost per trade.

Swap Fees (Overnight Charges)

-

Holding Trades Overnight?

You may pay or receive a swap/rollover fee depending on the interest rate differential of the traded currencies. -

Important in Long-Term Strategies:

Swing traders and position traders should compare swap rates between brokers, especially for exotic pairs or high-leverage accounts.

Pro Tip

Look for brokers that publish a detailed fee schedule. Transparency is a strong trust signal. Avoid brokers that hide fees in the fine print or don’t clearly state their swap policies.

Tools to Look For

- Economic calendars

- Autochartist or Trading Central integration

- Risk management calculators

Market Access: Trade Beyond Just Forex

In 2025, a well-rounded trader needs more than access to currency pairs. Top brokers now offer exposure to multiple global markets via CFDs (Contracts for Difference), allowing you to diversify your strategy and take advantage of volatility across different asset classes—all from a single platform.

Forex Pairs

- Major Pairs: EUR/USD, GBP/USD, USD/JPY – high liquidity and low spreads.

- Minor Pairs: EUR/GBP, AUD/CAD – moderate volume with good volatility.

- Exotic Pairs: USD/TRY, EUR/ZAR – higher risk but potentially higher returns.

Example:

- IC Markets and Pepperstone offer 60+ currency pairs with spreads from 0.0 pips and deep liquidity sourced from tier-1 institutions.

- eToro offers fewer currency pairs but adds value through social trading and crypto exposure.

CFDs on Other Asset Classes

Asset Class | What to Look For | Top Brokers Offering It |

Commodities | Gold, silver, oil, natural gas | XM, FP Markets, AvaTrade |

Indices | S&P 500, NASDAQ, DAX, FTSE | Plus500, FxPro, IG |

Stocks (CFDs) | US, EU, and Asia-Pacific equities | eToro, Admirals, XTB |

Crypto | BTC, ETH, XRP, altcoins (region-dependent) | Binance, eToro, Eightcap |

Example Use Case:

- If forex volatility is low, traders might shift to gold (XAU/USD) or US tech stocks.

- Some brokers like Eightcap offer crypto-only accounts, while Admirals lets you trade both stocks and forex from a single MT5 platform.

Why Broad Market Access Matters

- Diversification reduces your risk exposure by not relying on a single asset class.

- Hedging Opportunities allow traders to mitigate risk—for example, long gold vs short USD in times of inflation.

- Flexibility to Adapt: Market sentiment changes fast. With multi-asset access, you can always find a trend to ride.

Pro Tip

Look for brokers that offer multi-asset support on the same platform, like MT5 or a proprietary web platform. This streamlines trading and reduces the learning curve across markets.

Broker Type: Understanding Market Makers, STP/DMA, and ECN

Choosing the right broker type is crucial because it affects how your trades are executed, your costs, and potential conflicts of interest. In 2025, three main broker models dominate the forex industry: Market Makers, STP/DMA, and ECN. Understanding their differences helps you select a broker aligned with your trading style and priorities.

Market Makers

- Market makers act as the counterparty to their clients' trades, effectively "making the market" by providing liquidity themselves rather than routing orders to external liquidity providers.

- They internalize order flow, meaning they take the opposite side of client trades.

- Typically offer fixed spreads and no commissions, making them accessible for smaller retail traders.

- Execution occurs in-house via a dealing desk.

- They may have wider spreads and potential conflicts of interest since they profit when clients lose.

- Benefits include fast execution, fixed spreads, no commissions, and a lower entry barrier.

STP (Straight Through Processing) / DMA (Direct Market Access)

- STP brokers route client orders directly to liquidity providers without dealing desk intervention.

- DMA brokers are similar to STP brokers, providing direct market access to the interbank market.

- Both provide access to multiple liquidity providers, resulting in tighter spreads than market makers.

- They charge commissions or markups on spreads.

- Execution is generally faster and more transparent than with market makers.

- Suitable for beginner to intermediate traders who want to avoid requotes and benefit from better pricing.

| Feature | Market Maker | STP / DMA | ECN |

| Order Execution | In-house dealing desk | Direct to liquidity providers | Direct via electronic network |

| Liquidity Source | Broker’s own liquidity | Multiple liquidity providers | Multiple liquidity providers |

| Spreads | Fixed, wider | Variable, tighter | Variable, tightest |

| Commissions | Usually none | Charged per trade | Charged per trade |

| Conflict of Interest | High (broker trades vs client) | Low | Low |

| Trading Hours | Normal market hours | Extended | Extended |

| Best For | Beginners, small accounts | Beginners to intermediate | Experienced traders |

In essence, Market Makers create liquidity internally and trade against clients, STP/DMA brokers provide direct access to external liquidity with no dealing desk, and ECN brokers offer the most direct and transparent market access by matching client orders electronically with other market participants without taking the opposite side of trades. ECN brokers typically have the tightest spreads but charge commissions, making them suitable for active and experienced traders

Execution Speed & Slippage: Why Speed Matters in Forex Trading

In forex trading, execution speed refers to how quickly your broker can process your trade orders. Slippage is the difference between the expected price of a trade and the price at which it is actually executed. Both factors play a critical role in your overall trading performance, especially if you use fast-paced strategies like scalping or automated trading systems.

Why Execution Speed Is Crucial

-

Fast Execution Minimizes Missed Opportunities:

Forex markets move rapidly, often shifting within milliseconds. Brokers with quick order execution ensure your trades enter the market at the intended price, increasing your chances of profitability. -

Reduces Requotes and Order Rejections:

Slow execution can result in requotes (where the broker offers a new price before executing your order) or outright rejections during volatile market conditions, disrupting your trading plans. -

Critical for Scalpers and EAs:

Traders who rely on scalping (quick in-and-out trades) or automated Expert Advisors (EAs) require lightning-fast execution to capitalize on small price movements before they vanish.

Understanding Slippage

-

What Causes Slippage?

Slippage occurs when the market price moves between the time you place an order and when it is executed, often during high volatility or low liquidity periods. - Positive vs Negative Slippage

- Positive Slippage means your order is executed at a better price than expected (rare but beneficial).

- Negative Slippage means execution at a worse price, increasing costs.

-

Minimizing Slippage:

Choose brokers with fast execution speeds and reliable technology infrastructure. Using limit orders instead of market orders can help avoid slippage by specifying your maximum acceptable price.

What to Look for in a Broker Regarding Execution

Feature | Importance for Traders | What to Expect from a Quality Broker |

Execution Model | STP, ECN models typically faster than Market Makers | Transparent, direct routing to liquidity providers |

Latency | Time delay between order placement and execution | Low latency servers, often colocated near exchanges |

Order Types Supported | Market, Limit, Stop orders for flexible execution | Variety of order types to manage slippage and risk |

Slippage Policies | Clear disclosure of how slippage is handled | Broker must provide info on slippage occurrences and protections |

Pro Tip

During major news events like Non-Farm Payrolls or central bank announcements, expect increased volatility and potential slippage. It’s advisable to use limit orders or reduce position sizes to manage risk during these times.

Broker Examples with Noted Execution Speeds

- IC Markets: Known for ultra-fast ECN execution speeds averaging 1-3 milliseconds, ideal for scalpers.

- Pepperstone: Offers both STP and ECN accounts with low latency and minimal slippage.

- Plus500: Market Maker model with slightly slower execution; better suited for casual traders.

- FXPro: STP model with competitive execution and solid infrastructure.

Platforms & Trading Tools: Powering Your Forex Trading Experience

Choosing a forex broker with the right trading platform and tools is fundamental to executing your strategy effectively. In 2025, top brokers offer a range of powerful platforms that cater to beginners, technical traders, and algorithmic system users alike.

Popular Trading Platforms to Consider

Platform | Overview | Best For | Key Features |

MetaTrader 4 (MT4) | Industry-standard platform since 2005 | Beginners, automated trading (EAs) | Custom indicators, Expert Advisors, backtesting |

MetaTrader 5 (MT5) | Next-gen version with multi-asset support | Advanced traders, multi-asset trading | More timeframes, economic calendar, market depth |

cTrader | ECN-focused platform with intuitive UI | Scalpers, ECN traders | Level II pricing, advanced order types, algorithmic trading |

Proprietary Platforms | Broker-developed platforms with unique tools | Casual traders, copy trading enthusiasts | Often simplified UI, social trading, mobile apps |

TradingView | Web-based charting & social trading | Technical analysts, community sharing | Rich charting tools, community scripts, alerts |

Key Trading Tools to Enhance Your Edge

-

Copy Trading & Social Trading:

Platforms like eToro and NAGA offer copy trading, allowing beginners to mirror strategies of experienced traders in real-time. This is excellent for learning and passive income. - AutoChartist: Automated technical analysis tool that scans markets for patterns, key levels, and volatility indicators, giving traders alerts on potential trade setups.

-

Trading Central:

Provides in-depth market analysis, trade signals, and economic news integrated within the trading platform, helping traders make informed decisions. -

Economic Calendars & News Feeds:

Real-time calendars track scheduled economic events, enabling traders to prepare for market-moving announcements. -

Backtesting & Strategy Testing:

Platforms like MT4/MT5 allow traders to test expert advisors or manual strategies against historical data to evaluate performance.

Mobile & Web Trading

-

Mobile Apps:

Most brokers provide mobile versions of popular platforms (MT4, MT5, proprietary apps) enabling traders to monitor and manage positions on the go. -

Web-Based Trading:

Browser-based platforms allow quick access without downloads, perfect for traders who want flexibility and fast access anywhere.

Regulation & Safety: Protecting Your Funds and Trading Integrity

In 2025, the importance of choosing a regulated and safe forex broker cannot be overstated. Regulation ensures brokers operate transparently, adhere to strict financial standards, and provide protections that safeguard your capital.

Why Regulation Matters

-

Client Fund Protection:

Regulated brokers must keep client funds in segregated accounts, separate from their operational capital. This prevents misuse of your money even if the broker faces financial trouble. -

Transparency and Fairness:

Regulatory authorities enforce standards for fair pricing, honest marketing, and dispute resolution, creating a level playing field for traders. -

Reduced Fraud Risk:

Forex is a lucrative but sometimes risky market — regulation reduces the risk of scams, ensuring brokers meet rigorous licensing requirements.

Red Flags to Avoid

- Brokers without any regulation or with licenses from dubious jurisdictions (e.g., offshore zones with lax oversight).

- Promises of guaranteed profits or leverage levels exceeding regulatory limits.

- Lack of transparency in fees, execution policies, or company ownership.

Additional Safety Features to Check

-

Negative Balance Protection:

Prevents your account from falling below zero in volatile market conditions, safeguarding you from owing money beyond your deposits. -

Investor Compensation Schemes:

Some regulators provide compensation funds to cover client losses if the broker goes bankrupt (e.g., up to €20,000 under CySEC). -

Two-Factor Authentication (2FA):

Enhances account security by requiring a second verification step during login.

Regulation is essential for protecting traders’ funds and ensuring fair market practices. Licensed brokers comply with strict standards set by authorities like the FCA or CFTC, which include:

- Client Fund Protection: Segregation of client funds from broker’s own money to safeguard assets.

- AML and KYC Procedures: Verification processes to prevent money laundering and illegal activities.

- Transparency: Clear disclosure of trading risks, execution policies, and leverage limits to protect traders.

- Market Integrity: Prevention of fraud, price manipulation, and unfair practices.

- Record-Keeping: Brokers maintain detailed transaction records for regulatory oversight.

Choosing a regulated broker ensures a safer trading environment, reduces fraud risk, and promotes trust and fairness in the Forex market.

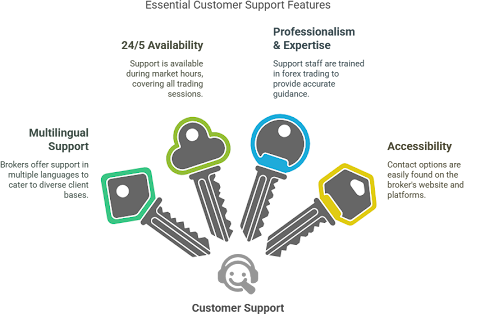

Customer Support: Your Lifeline in the Trading Journey

Excellent customer support is a cornerstone of a trustworthy forex broker. Whether you’re a beginner facing technical issues or an experienced trader with urgent queries, accessible and knowledgeable support can save time, reduce stress, and even prevent costly mistakes.

Why Quality Customer Support Matters

-

Immediate Issue Resolution:

Trading involves time-sensitive decisions. Responsive support helps resolve platform glitches, withdrawal problems, or order execution questions promptly. -

Confidence & Trust:

Knowing help is just a click or call away builds trader confidence, especially for newcomers navigating complex systems. -

Educational Guidance:

Proactive brokers offer assistance not only with technical issues but also with educational resources, account setup, and trading tips.

Support Channels to Expect

Channel | Pros | Cons | Best For |

Live Chat | Instant, convenient, and widely available | Sometimes limited hours | Quick answers, tech support |

Phone Support | Personal, detailed explanations possible | Can have wait times | Complex issues, urgent problems |

Detailed written responses, good for records | Slower response times | Non-urgent queries, documentation | |

FAQ & Knowledge Base | 24/7 access to common questions | Not personalized | Self-help, learning basics |

Social Media | Quick replies, public visibility | Not suitable for confidential info | General inquiries, updates |

Key Qualities of Great Customer Support

-

Multilingual Support:

Global brokers typically offer support in multiple languages, catering to diverse client bases. -

24/5 Availability:

Support should align with market hours, available at least from Sunday evening to Friday evening to cover all trading sessions. -

Professionalism & Expertise:

Support staff should have sufficient training in forex trading to provide accurate and helpful guidance. -

Accessibility:

Easy-to-find contact options on the broker's website and in trading platforms.

Leverage & Margin Requirements: Balancing Opportunity with Risk

Leverage is one of forex trading’s most powerful features, allowing traders to control large positions with relatively small amounts of capital. However, it is a double-edged sword—amplifying both potential profits and losses. Understanding leverage and margin requirements is essential for managing risk effectively in 2025.

What is Leverage?

Leverage is the ratio between the amount of money you control in the market and the capital you actually invest (your margin). For example, a leverage of 1:100 means you can control $100,000 in currency with just $1,000 of your own money.

How Margin Works

Margin is the deposit required to open and maintain a leveraged position. If your position moves against you, your losses will be deducted from this margin. If the margin falls below the broker’s maintenance level, you may receive a margin call requiring additional funds or a forced position closure.

Regulatory Leverage Limits

Different regions impose leverage caps to protect retail traders:

Region | Max Retail Trader Leverage | Notes |

European Union (ESMA) | 1:30 for major pairs | Lower leverage for exotic pairs |

United States (NFA) | 1:50 for major pairs | Strict leverage limits |

Australia (ASIC) | 1:30 | Similar to EU regulations |

UK (FCA) | 1:30 | Follows ESMA rules |

Offshore Brokers | Up to 1:500 or higher | Higher risk, less regulated |

Choosing the Right Leverage

- Beginners: Lower leverage (1:10 to 1:30) helps control risk and avoid rapid account depletion.

- Experienced Traders: Higher leverage (1:50 to 1:200) offers more flexibility but demands strict risk management.

- Scalpers and EAs: Often prefer ultra-fast execution with moderate leverage to optimize short-term gains without excessive risk.

Margin Requirements Comparison

Broker | Max Leverage | Typical Margin Requirement for 1 Lot (100,000 units) | Notes |

IC Markets | Up to 1:500 | $200 | High leverage for experienced traders |

Pepperstone | Up to 1:500 | $200 | Flexible leverage options |

FxPro | Up to 1:200 | $500 | Lower max leverage, safer for beginners |

eToro | Up to 1:30 (retail) | $3,333 | Follows ESMA limits |

Fintana | Up to 1:400 | $250 | Balanced leverage, commission-free |

Risks of High Leverage

- Amplified Losses: Just as profits multiply, so do losses—potentially exceeding your initial investment if not protected.

- Margin Calls & Stop-Outs: Brokers close losing positions automatically when margin drops below required levels, possibly at unfavorable prices.

- Emotional Stress: High leverage can tempt reckless trading, causing poor decisions and account blowouts.

Best Practices for Using Leverage

- Use leverage conservatively, especially when starting out.

- Always set stop-loss orders to limit downside risk.

- Maintain sufficient margin buffer to avoid margin calls.

- Regularly monitor margin levels and avoid over-leveraging multiple positions simultaneously.

- Practice on a demo account to understand leverage impact without risking real money.

Risk Management Features: Protecting Your Capital in Forex Trading

In forex trading, risk management is the difference between consistent profits and costly mistakes. Effective brokers provide tools that help traders control losses, protect profits, and navigate volatile markets with confidence. In 2025, choosing a broker with robust risk management features is non-negotiable for sustainable success.

Essential Risk Management Tools to Look For

Feature | Description | Benefit to Trader |

Stop-Loss Orders | Automatically close a trade at a predefined loss level | Limits potential losses on each trade |

Take-Profit Orders | Close a trade once a desired profit target is reached | Secures profits without manual monitoring |

Trailing Stop | A dynamic stop-loss that moves with the market price | Locks in profits while allowing upside potential |

Margin Call Alerts | Notifications when margin levels approach critical thresholds | Prevents unexpected position closures |

Negative Balance Protection | Guarantees the trader cannot lose more than their account balance | Protects against debt beyond deposited funds |

Demo Accounts | Practice accounts with virtual funds | Safe environment to test strategies and risk management without financial loss |

Why These Features Matter

-

Stop-Loss and Take-Profit Orders:

These orders enable automated risk control, crucial during market gaps or when traders cannot monitor positions 24/7. For example, if you enter a EUR/USD long position at 1.1000 with a stop-loss at 1.0950, your maximum loss is capped at 50 pips. -

Trailing Stops:

As the price moves favorably, trailing stops adjust your stop-loss level accordingly, maximizing gains while limiting risk. This is especially useful for swing traders and those who can't constantly monitor the market. -

Margin Call Alerts:

Early warnings allow traders to add funds or close positions to avoid forced liquidation, which can often occur at unfavorable prices during volatile market conditions. -

Negative Balance Protection:

This regulatory requirement from brokers licensed in top-tier jurisdictions prevents traders from incurring debts beyond their deposited capital, a vital safety net during extreme market volatility. -

Demo Accounts:

Essential for beginners to familiarize themselves with risk management tools and for advanced traders to test new strategies without risking real money.

Practical Tips to Maximize Risk Management

- Always set a stop-loss on every trade; never trade without it.

- Use take-profit orders to automate your exit strategy.

- For volatile pairs or when holding trades overnight, consider trailing stops to safeguard profits.

- Monitor margin levels actively and set alerts if your platform allows.

- Use demo accounts to practice placing different order types and managing trades.

- Choose brokers that explicitly advertise and enforce negative balance protection for peace of mind.

Education & Learning Resources: Building Your Forex Knowledge Foundation

Choosing a forex broker with comprehensive education and learning resources is a game-changer for traders at all levels—especially beginners. In 2025, top brokers not only provide trading platforms but also invest heavily in empowering traders with the knowledge and skills necessary to succeed in the dynamic forex market.

Why Education Matters in Forex Trading

Forex trading is complex, influenced by global economic events, technical analysis, and evolving market sentiment. Without solid education, traders risk costly mistakes and emotional trading decisions. Educational support helps you:

- Understand market fundamentals and technical indicators.

- Develop and test trading strategies.

- Stay updated on market news and economic events.

- Build confidence to trade independently and strategically.

Key Educational Resources to Look For

Resource Type | Description | How It Benefits Traders |

Webinars & Live Training | Interactive sessions covering market analysis, strategies, and platform tutorials | Real-time learning and direct Q&A |

Video Tutorials | Step-by-step guides on trading basics, indicators, and advanced techniques | Visual and easy-to-follow learning |

eBooks & Guides | In-depth manuals on forex trading, risk management, and strategy development | Comprehensive knowledge on demand |

Demo Accounts | Practice environments with virtual funds | Hands-on experience without financial risk |

Market Analysis & News | Daily or weekly updates on market conditions, economic releases, and forecasts | Helps traders make informed decisions |

Trading Tools & Calculators | Position size calculators, pip calculators, and economic calendars | Assists in precise trade planning |

Community Forums & Support Groups | Platforms for peer discussion and strategy sharing | Collaborative learning and networking |

How to Use Educational Resources Effectively

- Start with basic tutorials and eBooks if you're new to forex trading.

- Attend live webinars to ask questions and get up-to-date insights.

- Practice strategies using the demo account before risking real capital.

- Follow daily market news and analysis to understand the impact of economic events.

- Join forums or community groups to share experiences and learn from others.

- Regularly revisit educational content to refine your skills as markets evolve.

Account Types & Flexibility: Finding the Perfect Fit for Your Trading Style

Choosing the right account type with your forex broker is essential to match your trading goals, experience level, and capital. In 2025, brokers offer diverse account options tailored to various trader profiles—from beginners to professionals—providing flexibility, customized features, and benefits.

Common Forex Account Types Explained

Account Type | Description | Ideal For | Typical Features |

Standard Account | Entry-level account with moderate spreads and standard leverage | Beginner to intermediate traders | Low minimum deposit, commission-free or low commission, standard spreads |

Pro Account | Enhanced trading conditions with tighter spreads and faster execution | Experienced traders | Lower spreads, commissions per trade, higher leverage options |

VIP/Premium Account | Premium services with personalized support, exclusive tools, and lowest spreads | High-volume or institutional traders | Dedicated account managers, lower fees, priority withdrawals |

Swap-Free (Islamic) Account | Complies with Sharia law by eliminating overnight interest fees | Traders requiring halal trading | No swap/rollover fees, otherwise similar to standard accounts |

Mini/Micro Account | Very low minimum deposits and smaller trade sizes (micro lots) | Beginners or low-capital traders | Enables risk control, ideal for testing strategies |

Demo Account | Virtual trading environment with no real money risk | All traders, especially beginners | Practice trading, test strategies and platforms |

How to Choose the Best Account Type

- Assess your trading capital: Low capital may suit mini or standard accounts, while professional traders benefit from VIP accounts.

- Consider your trading frequency and volume: High-frequency traders may prefer accounts with lower commissions and spreads.

- Check leverage and margin requirements: Different accounts offer varying leverage limits; choose one matching your risk tolerance.

- Look for flexibility: The ability to switch between account types or upgrade as your skills grow is advantageous.

- Confirm access to exclusive features: Some accounts provide advanced tools, dedicated support, or market insights.

Conclusion

Selecting the right forex broker is the foundation of a successful trading journey. In 2025, with an ever-expanding and competitive market, making an informed choice is more important than ever. A reliable broker empowers you with competitive pricing, robust market access, fast execution, and advanced trading tools while ensuring regulatory compliance and transparent operations.

From understanding spreads, commissions, and fees, to verifying regulation and reputation, every factor we discussed plays a vital role in shaping your trading experience. Consider your unique trading style, capital, and risk tolerance when choosing account types, leverage options, and risk management features. Don’t overlook the importance of responsive customer support and educational resources that can accelerate your learning curve and refine your strategy.

Remember, the best broker is one who aligns with your goals, offers a secure and transparent environment, and continuously supports your growth as a trader. Use this guide as a comprehensive checklist to evaluate brokers critically, and take advantage of demo accounts to test platforms before committing real capital.

By prioritizing these factors, you maximize your chances of not only protecting your investment but also enhancing your potential for consistent profitability in the fast-moving forex markets.

Ready to Find the Best Forex Broker for You?

Don’t leave your trading success to chance. Explore our full breakdown of the Top 10 Best Forex Brokers in 2025 to compare features, fees, and platforms — and choose the one that fits your strategy.

Make your next trade with confidence — Start your broker comparison now.