Plus500 Review

Plus500 - The Need for Reliable Trading Platforms in Online Trading

In the fast-paced world of online trading, finding a reliable and user-friendly platform is crucial for traders of all experience levels. Plus500, a leading CFD (Contract for Difference) trading platform, has gained widespread recognition for its simplicity and versatility. But is it the right choice for you? This review dives deep into Plus500’s features, strengths, and weaknesses to help you decide.

Plus500 - Overview

Established in 2008, Plus500 is a global CFD trading platform offering a wide range of financial instruments, including forex, stocks, commodities, indices, cryptocurrencies, and ETFs. Regulated by top-tier authorities like the UK’s Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), and Cyprus Securities and Exchange Commission (CySEC), Plus500 ensures a secure and transparent trading environment. Its accessibility across web and mobile platforms makes it a popular choice for traders worldwide.

Security and Regulation: Commitment to Secure Trading

Plus500 prioritizes security, employing advanced encryption to safeguard data and transactions. Client funds are segregated from the company’s operating funds, ensuring added protection. It’s regulation by:

- UK’s Financial Conduct Authority (FCA)

- the Australian Securities and Investments Commission (ASIC), and

- Cyprus Securities and Exchange Commission (CySEC)

Further reinforces its credibility, offering traders peace of mind.

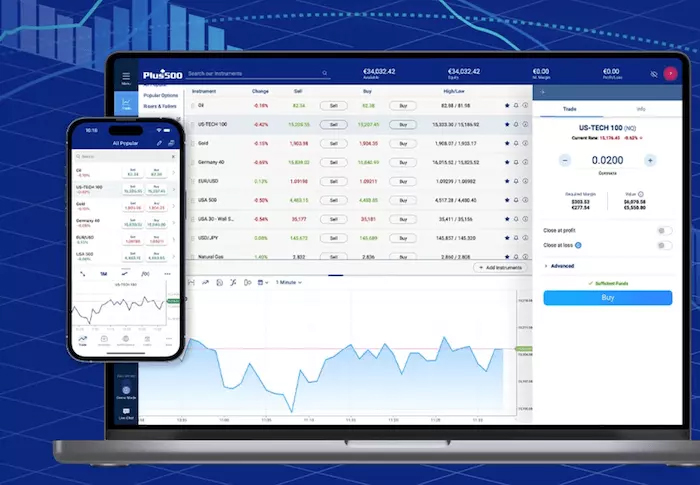

User Interface and Experience - A Simple Platform for All Traders

Plus500’s intuitive and user-friendly interface is one of its standout features. Designed for both beginners and experienced traders, the platform offers:

- A clean, well-organized dashboard with easy access to essential tools.

- Seamless trading via web-based and mobile apps (iOS and Android).

- A straightforward experience, free from overwhelming charts and indicators.

- A demo account for beginners to practice without risking real money.

This simplicity makes Plus500 an excellent choice for traders who value ease of use.

Diverse Selection of Trading Instruments

Plus500 offers over 2,000 CFDs, catering to traders with diverse strategies. Key instruments include:

| Instrument Category | Description |

| Forex | Major, minor, and exotic currency pairs with competitive spreads. |

| Stocks | CFDs on shares of leading global companies. |

| Commodities | CFDs on gold, silver, oil, and natural gas. |

| Indices | Exposure to global indices like the S&P 500, FTSE 100, and NASDAQ. |

| Cryptocurrencies | CFDs on popular cryptos like Bitcoin, Ethereum, and Ripple. |

| ETFs | CFDs on Exchange-Traded Funds tracking various sectors. |

This extensive range enables traders to diversify their portfolios and capitalize on diverse market opportunities.

Advanced Trading Tools for Enhanced Experience

Plus500 provides a suite of tools to enhance the trading experience:

- Leverage: Amplify positions on select instruments, though traders should use caution due to increased risk.

- Risk Management Tools: Stop-loss, take-profit, and guaranteed stop-loss orders to protect capital.

- Real-Time Charts: Customizable charts with technical indicators and drawing tools for effective market analysis.

- Economic Calendar: Stay informed about market-moving events like interest rate decisions and GDP reports.

- Alerts and Notifications: Set price alerts to stay updated without constant monitoring.

These features make Plus500 a robust platform for both strategic and casual traders.

Fees and Spreads - Transparent Fee Structure for Clear Trading Costs

Plus500 operates on a transparent fee structure, earning revenue through spreads rather than commissions. Key fees include:

| Fee Type | Details |

| Deposit & Withdrawal Fees | No fees charged by Plus500; third-party fees may apply (e.g., banks, card issuers). |

| Buy/Sell Spread | Plus500 earns through the spread, not commissions. |

| Overnight Funding | Charged when positions are held open overnight, added or subtracted based on the position. |

| Currency Conversion Fee | Applied when trading in a currency different from your account currency, up to 0.7%. |

| Guaranteed Stop Order | Involves a wider spread to guarantee position closure at a specified rate. |

| Inactivity Fee | Charged after 3 months of inactivity, up to USD 10/month. |

Customer Support - How to Get Assistance on Plus500

Customer support is available via email and live chat, with a comprehensive FAQ section for common queries. The live chat feature is particularly useful for quick responses. However, the lack of phone support and occasional delays in resolving complex issues may frustrate some users.

Plus500 - Pros and Cons

Pros

- Intuitive, user-friendly interface.

- Wide range of tradable instruments.

- Competitive spreads on major assets.

- Robust risk management tools.

- Strong regulatory oversight and security measures.

Cons

- No phone support.

- Inactivity fees for dormant accounts.

- Limited educational resources for beginners.

- Wider spreads on less popular instruments or during volatility.

Conclusion

Plus500 is a reliable and versatile CFD trading platform, ideal for traders seeking simplicity and a broad range of instruments. Its intuitive design, competitive spreads, and strong regulatory framework make it a compelling choice for both beginners and experienced traders. However, the lack of phone support, inactivity fees, and limited educational resources may deter some users.

Overall, Plus500’s strengths outweigh its weaknesses, making it a solid option for those looking for a straightforward and efficient trading platform. As with any trading platform, thorough research and an understanding of the risks involved are essential before diving in. Whether you’re a novice or a seasoned trader, Plus500 is worth considering for your trading journey.