Absolute Return Definition

In the world of trading and investing, understanding different performance metrics is crucial for making informed decisions. One such important concept is absolute return. This term often appears in fund reports, investment analyses, and trading strategies, but what exactly does it mean? Let’s break it down.

Key Takeaways

- Absolute return is the total percentage gain or loss on an investment over a period, independent of any benchmark.

- It provides a clear, straightforward measure of investment performance.

- Absolute return is especially important for strategies aiming to generate positive returns regardless of market direction.

- Unlike relative return, it does not compare performance to an index or peer group.

- Investors should consider absolute return alongside risk and market context for a complete picture.

Definition of Absolute Return

Absolute return refers to the total return that an investment achieves over a specific period, expressed as a percentage of the initial investment amount. Unlike relative return, which compares performance against a benchmark or index, absolute return measures the raw gain or loss without any external reference.

In simple terms, absolute return answers the question:

“How much money did I make or lose on this investment?”

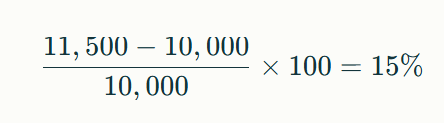

For example, if you invested $10,000 in a stock and after one year it is worth $11,500, your absolute return is:

This 15% is the absolute return, showing the direct increase in your investment value.

Why Is Absolute Return Important?

- Clear Performance Measure: Absolute return provides a straightforward way to evaluate how much an investment has grown or shrunk.

- Benchmark-Free: It does not rely on comparing to market indices or other investments, making it useful for strategies that aim to generate positive returns regardless of market conditions.

- Focus on Real Gains: Investors focused on preserving capital or generating positive cash flow often prioritize absolute returns over relative returns.

- Used in Absolute Return Strategies: Many hedge funds and alternative investment vehicles use absolute return strategies, aiming to deliver positive returns in both rising and falling markets.

Absolute Return vs. Relative Return

- Absolute Return: Measures the actual gain or loss on an investment.

- Relative Return: Measures performance compared to a benchmark (e.g., S&P 500, FTSE 100).

- For example, if a fund returns 8% but the benchmark returns 10%, the absolute return is 8%, but the relative return is -2% (underperformance).

Limitations of Absolute Return

- No Context on Market Conditions: Absolute return alone doesn’t tell you if the return is good or bad relative to the market.

- Can Be Misleading Over Short Periods: A high absolute return in a short time might be due to high risk or volatility.

- Does Not Account for Risk: Two investments with the same absolute return might have very different risk profiles.

- Understanding absolute return helps traders and investors evaluate their investments more effectively and align their strategies with their financial goals. Whether you are managing a portfolio or analyzing a fund, knowing this fundamental concept is essential for making smarter trading decisions.