Drawdown Definition

Drawdown refers to the decline in the value of an investment, trading account, or portfolio from its peak to its lowest point (trough) during a specific period. It is typically expressed as a percentage and is a key metric used to measure risk, volatility, and the performance of trading strategies or investments.

Key Takeaways

- Drawdown measures the decline in value from a peak to a trough during a specific period.

- It is expressed as a percentage and helps assess risk and volatility.

- Larger drawdowns require exponentially greater gains for recovery.

- Effective risk management techniques can help minimize drawdowns and protect capital.

- Maximum drawdowns are particularly important for evaluating long-term investment strategies.

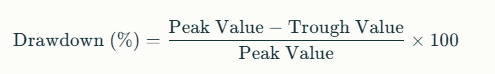

How Drawdown Is Calculated

To calculate drawdown:

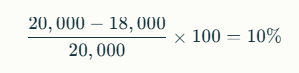

For example, if a trading account reaches a peak value of $20,000 and then drops to $18,000 before recovering, the drawdown is:

This means the account experienced a 10% drawdown during that period.

Types of Drawdowns

- Maximum Drawdown: The largest peak-to-trough decline over the life of an investment or trading account.

- Relative Drawdown: The percentage decline relative to the account's equity at the start of the period.

- Recovery Time: The time it takes for an investment or account to recover from a drawdown and return to its previous peak.

Why Drawdowns Matter

- Risk Assessment: Drawdowns help traders understand the downside risk of their strategies or investments.

- Performance Evaluation: They are used to compare the effectiveness of different trading systems or funds.

- Recovery Challenge: The larger the drawdown, the harder it is to recover. For example:

- A 10% drawdown requires an 11% gain to recover.

- A 50% drawdown requires a 100% gain to return to the peak.

How Drawdowns Impact Trading

- Emotional Stress: Large drawdowns can lead to emotional decision-making and loss of confidence in strategies.

- Capital Preservation: Managing drawdowns is crucial for long-term profitability and avoiding account depletion.

- Risk Management: Traders use tools like stop-loss orders, position sizing, and diversification to minimize drawdowns.

Example of a Drawdown

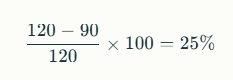

If an investor buys stock at $100 per share, and its price rises to $120 (peak), then falls to $90 (trough), the drawdown is:

This shows a 25% decline from the peak value.

Understanding drawdowns is essential for traders and investors aiming to manage risk effectively and maintain consistent performance in volatile markets.