Keltner Channel Definition

The Keltner Channel is a technical analysis indicator that consists of volatility-based bands (or “channels”) plotted above and below a moving average. It is designed to help traders identify trend direction, gauge volatility, and spot potential overbought or oversold conditions in financial markets.

Key Takeaways

- The Keltner Channel is a volatility-based technical indicator using a moving average and ATR-derived bands to identify trends, volatility, and overbought/oversold conditions.

- It consists of three lines: a central EMA, and upper/lower bands set a multiple of the ATR away from the EMA.

- The indicator is widely used for trend-following, breakout trading, and dynamic support/resistance identification across various asset classes.

- Settings can be adjusted (e.g., period length, ATR multiplier) to suit different trading styles and market conditions.

- Keltner Channels are less volatile than Bollinger Bands due to their use of ATR, providing smoother signals for traders.

Key Components

Middle Line

Typically a 20-period Exponential Moving Average (EMA) of the price, which serves as the basis for the channel.

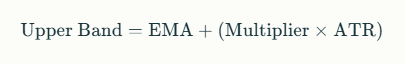

Upper Band

Calculated by adding a multiple (commonly 2) of the Average True Range (ATR) to the EMA.

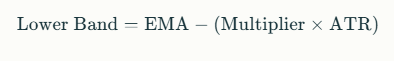

Lower Band

Calculated by subtracting the same multiple of the ATR from the EMA.

How It Works

- The Keltner Channel expands and contracts with market volatility, as measured by the ATR. When volatility rises, the channel widens; when volatility falls, the channel narrows.

- Price movement near the upper band may indicate overbought conditions, while movement near the lower band may signal oversold conditions.

- The indicator is used to identify trends: prices above the middle line suggest an uptrend, while prices below indicate a downtrend.

- Breakouts above or below the channel can signal potential trend reversals or the start of strong momentum moves.

Trading Applications

- Dynamic Support and Resistance

- The upper and lower bands act as dynamic resistance and support levels, respectively. In uptrends, price often stays in the upper half of the channel; in downtrends, it remains in the lower half.

- Breakout Signals

- Price closing above the upper band may be a bullish signal; closing below the lower band may be bearish.

- Volatility Assessment

- The width of the channel helps traders assess current market volatility and adapt their strategies accordingly.

Comparison to Bollinger Bands

- While both Keltner Channels and Bollinger Bands use three lines, Bollinger Bands set their bands based on standard deviation, whereas Keltner Channels use ATR, making them less sensitive to sharp price spikes and often smoother in appearance.

Origins and Evolution

- The Keltner Channel was first introduced by Chester W. Keltner in 1960, originally using a simple moving average and trading range. The modern version, popularized by Linda Raschke in the 1980s, uses an EMA and ATR for greater responsiveness to market conditions.