XTB Review

XTB Broker Review: A Concise Analysis

In the competitive world of online trading, XTB has emerged as a leading Forex and CFD broker, renowned for its cutting-edge technology, competitive pricing, and robust regulatory compliance. Established in 2002, XTB caters to both beginners and professionals, offering a diverse range of tradable instruments. This review delves into XTB’s regulatory framework, trading platforms, account types, fees, and customer support to help you decide if it’s the right broker for your needs.

Regulation and Security: Is XTB Safe?

Security and regulatory oversight are among the most critical factors when selecting a broker. XTB operates under strict regulations from reputable financial authorities:

- Financial Conduct Authority (FCA) – United Kingdom

- Cyprus Securities and Exchange Commission (CySEC) – Cyprus

- Polish Financial Supervision Authority (KNF) – Poland

- International Financial Services Commission (IFSC) – Belize

These regulatory bodies enforce strict standards, including fund segregation, negative balance protection, and regular audits. XTB also employs advanced encryption technologies to safeguard client data, ensuring a secure trading environment.

Trading Platforms: Cutting-Edge Technology for All Traders

|

Platform |

Features |

|

xStation 5 |

Modern, intuitive interface, fast execution, advanced charting tools, built-in risk management features. |

|

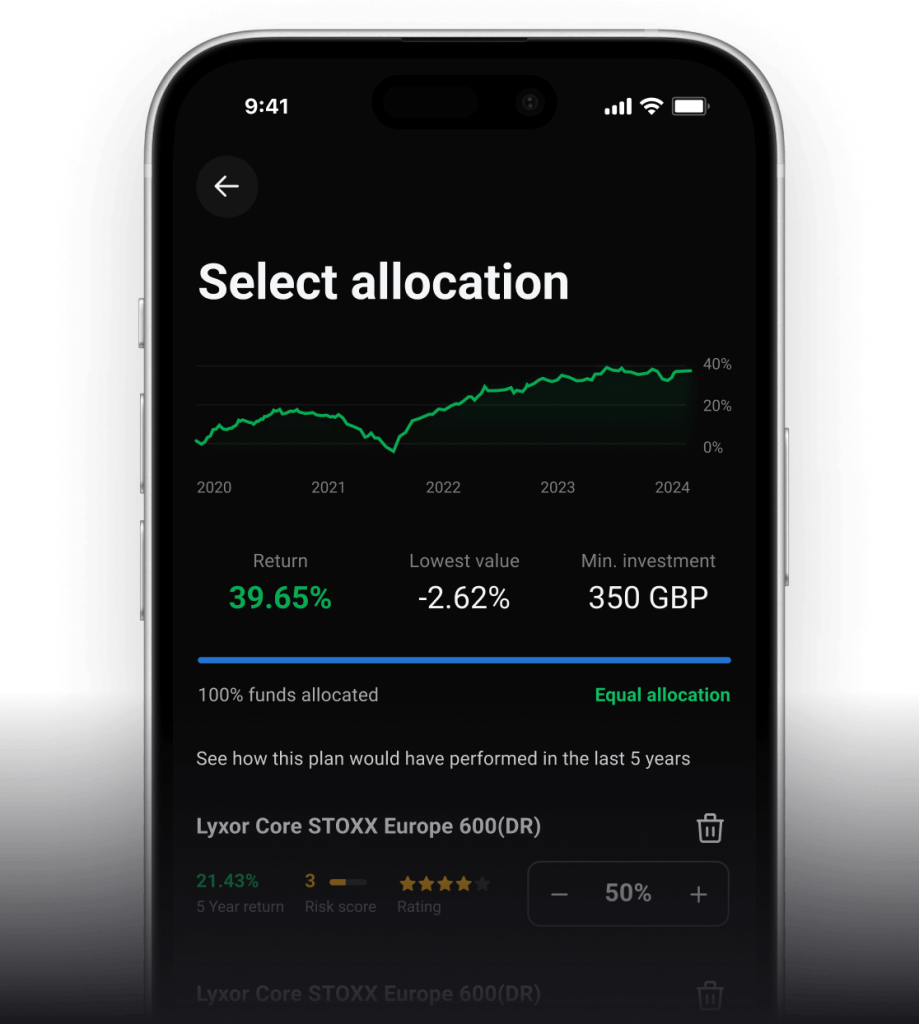

xStation Mobile |

Trade on the go with real-time price alerts, interactive charts, and full order management. |

|

xStation Web |

No download required, browser-based access with all essential trading tools. |

xStation 5 is widely praised for its intuitive design and seamless navigation. Traders appreciate features like one-click trading, customizable layouts, and real-time market sentiment analysis, which enhance decision-making and execution speed.

Account Types: Tailored Options for Different Traders

XTB offers two main account types: Standard and Pro. The Standard account is ideal for beginners, with no minimum deposit and no commissions, while the Pro account caters to experienced traders with tighter spreads and a small commission per lot.

Feature | Standard Account | Pro Account |

Minimum Deposit | None | None |

Spreads | From 0.9 pips | From 0.1 pips |

Commission | None | $3.50 per lot |

Leverage | Up to 1:500 | Up to 1:500 |

Trading Platforms | xStation 5 | xStation 5 |

Fees and Spreads: Competitive Pricing for Cost-Effective Trading

Fee Type | Details |

Spreads | From 0.9 pips (Standard) / 0.1 pips (Pro) |

Commission | $0 for Standard / $3.50 per lot for Pro |

Deposit Fees | Free |

Withdrawal Fees | Free |

Inactivity Fee | $10 per month after 12 months of inactivity |

Overnight Fees | Variable, based on market interest rates |

Deposits and Withdrawals: Convenient and Fast Transactions

XTB supports various deposit and withdrawal methods to ensure smooth transactions for its global clientele.

Payment Method | Processing Time | Fees |

Bank Transfer | 1-5 business days | Free (may vary) |

Credit/Debit Card | Instant | Free |

E-Wallets (Skrill, PayPal, Neteller) | Instant | May incur fees |

Withdrawals are typically processed within 24 hours, though delays may occur depending on the payment method or bank processing times. XTB does not charge withdrawal fees, but third-party providers (e.g., banks or e-wallets) may impose their own charges.

Customer Support: Reliable Assistance When You Need It

XTB provides excellent customer support, with many traders praising the quick response times and professionalism of the support team. The 24/5 live chat is particularly popular for resolving urgent issues, while the comprehensive FAQ section is a valuable self-help resource.

- 24/5 Live Chat: Fast and responsive assistance.

- Phone Support: Direct support in multiple languages.

- Email Support: Typically responds within 24 hours.

- Comprehensive FAQ Section: Answers to common queries and technical issues.

With multilingual support and educational assistance, XTB ensures a smooth trading experience for its clients.

Educational Resources: Learn & Trade with Confidence

XTB’s educational resources are designed to empower traders at all levels. Beginners can take advantage of structured trading courses, while advanced traders benefit from live webinars and in-depth market analysis. These resources not only build knowledge but also help traders apply strategies effectively in real-time markets.

Resource Type | Description |

Trading Courses | Beginner to advanced level courses covering trading strategies and risk management. |

Webinars & Seminars | Live sessions with market experts. |

Market Analysis | Daily insights, news updates, and fundamental analysis. |

Pros & Cons: Is XTB the Right Broker for You?

Pros

- Intuitive xStation 5 platform

- Competitive spreads starting from 0.1 pips

- Strong regulatory oversight (FCA, CySEC)

- Extensive educational resources

- Reliable 24/5 customer support

Cons

- Inactivity fees after 12 months

- Limited product portfolio compared to competitors

- No MetaTrader support

Conclusion

XTB stands out as a trusted and reliable broker, offering a powerful proprietary platform, competitive pricing, and a strong regulatory framework. While the lack of MetaTrader support and inactivity fees may be minor drawbacks, XTB’s user-friendly interface, extensive educational resources, and excellent customer support make it a top choice for Forex and CFD traders worldwide.